[ad_1]

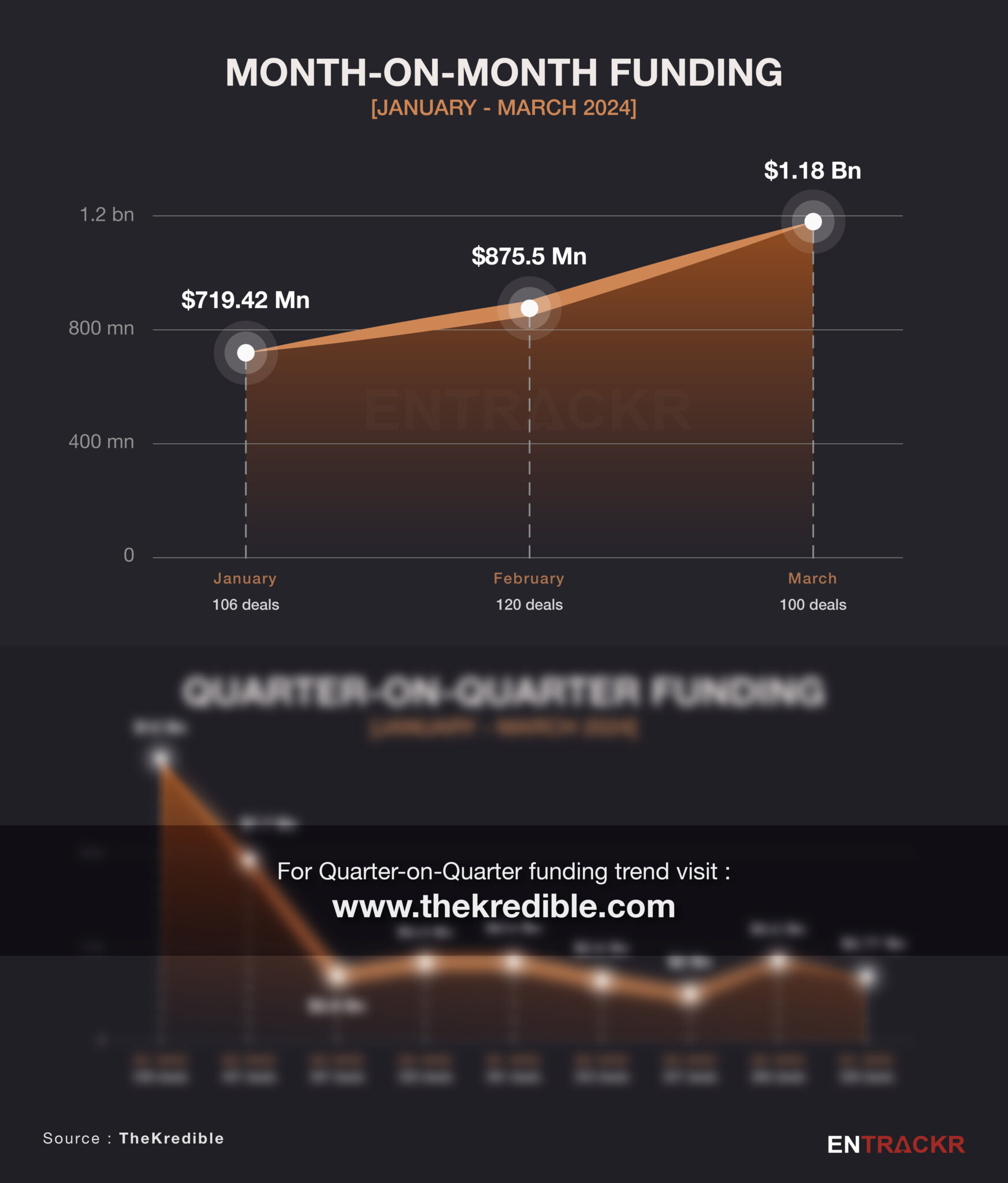

Indian startups registered a steady growth in fund inflow during the first quarter of 2023 as they managed to cross $2.75 billion in funding. Importantly, funding in March stood out for crossing the $1 billion threshold for the first time in 2024. However, even as funding recovers, layoffs, shutdowns and departure of top-level executives continue to loom.

Indian startups mopped up $2.77 billion across 326 deals in the March quarter or Q1 2024, as per data compiled by TheKredible. This included 74 growth-stage deals worth $1.87 billion and 213 early-stage deals amounting to $898 million. There were 39 undisclosed rounds.

Unlike in the first quarter of 2023, two startups – Krutrim SI Designs and Perfios – entered the unicorn club after their latest fundraise in the first quarter of 2024.

[Month-on-Month and Year-on-Year trend]

March saw a decent jump in funding to $1.18 billion from $875 million in February and over $700 million in January. However, on a year-on-year basis, Q1 2024 recorded a fall from $12 billion in Q1 2022 and $3.4 billion in Q1 2023.

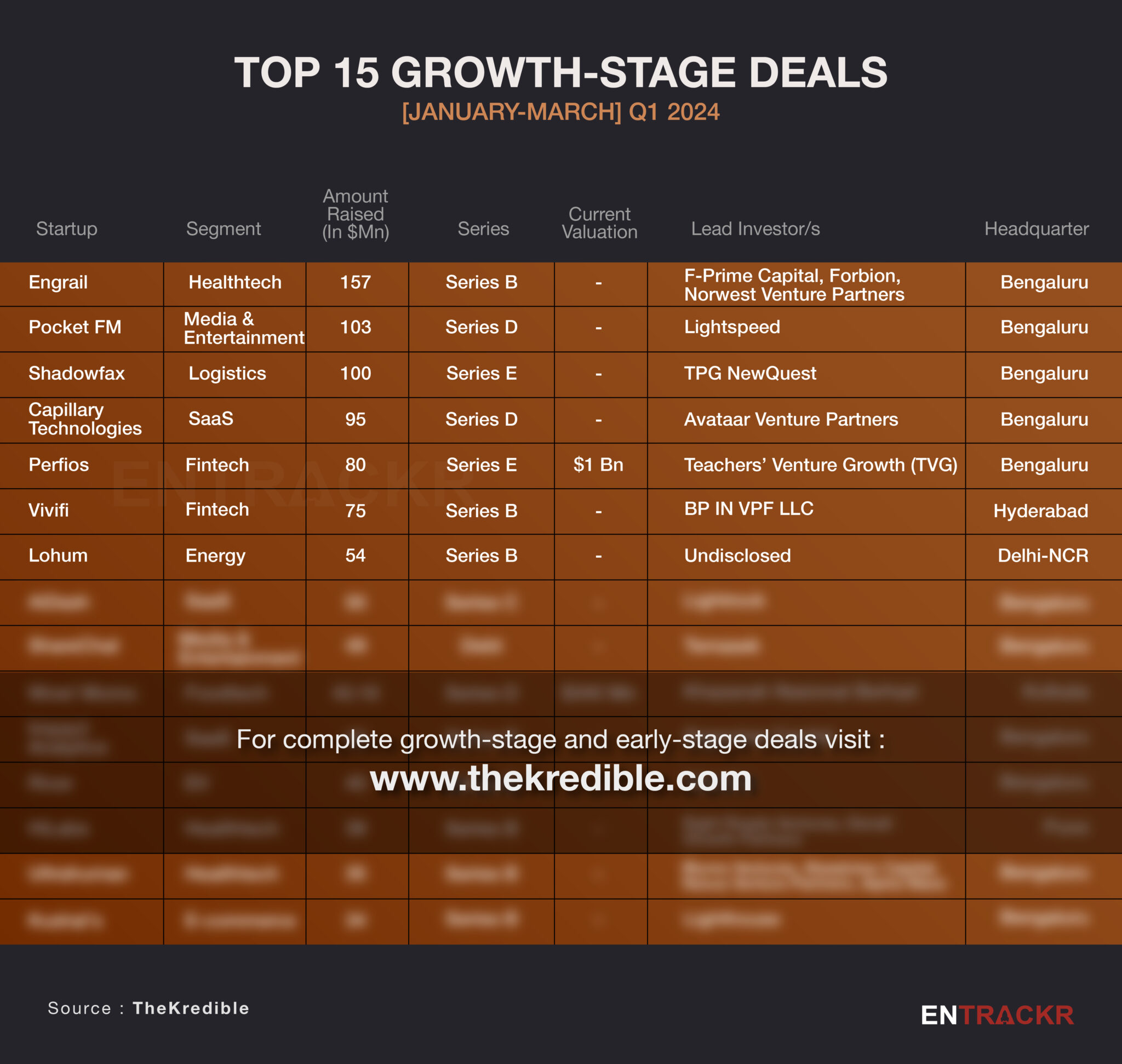

[Top growth stage deals]

Biotech startup Engrail scooped up $157 million in its Series B funding round to become the top-funded growth stage company in the first quarter of 2024. Audio series platform Pocket FM and logistics company Shadowfax managed to go past the $100 million funding mark in Q1 2024.

Capillary Technologies, Perfios, Vivifi, Lohum, AiDash, ShareChat and Wow! Momo, were among the top 10 growth-stage deals.

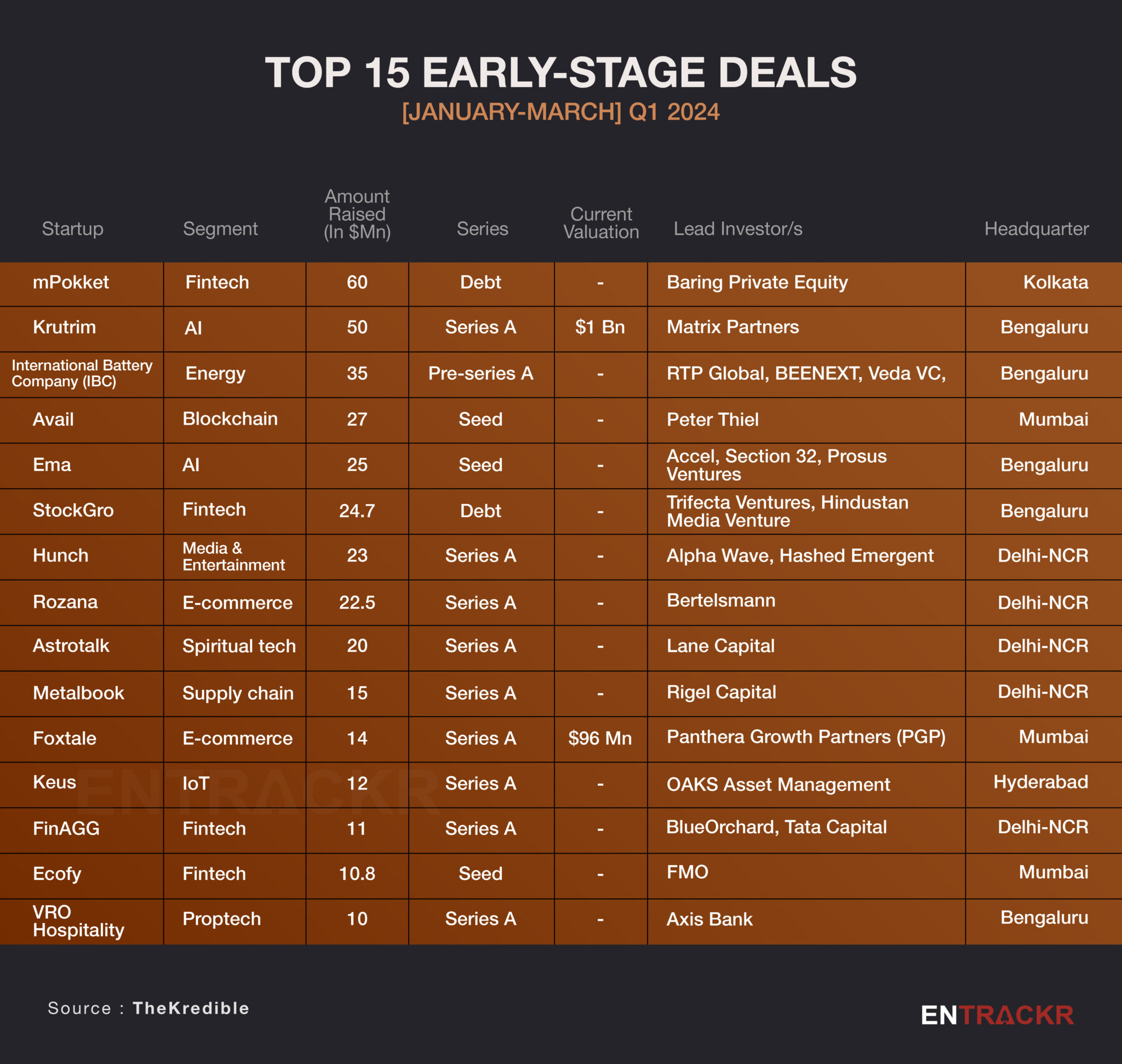

[Top early-stage deals]

Digital lending platform mPokket, AI company Krutrim, energy tech company International Battery Company (IBC), blockchain company Avail, and generative AI startup Ema topped the list of early-stage startups. Check TheKredible for a full list.

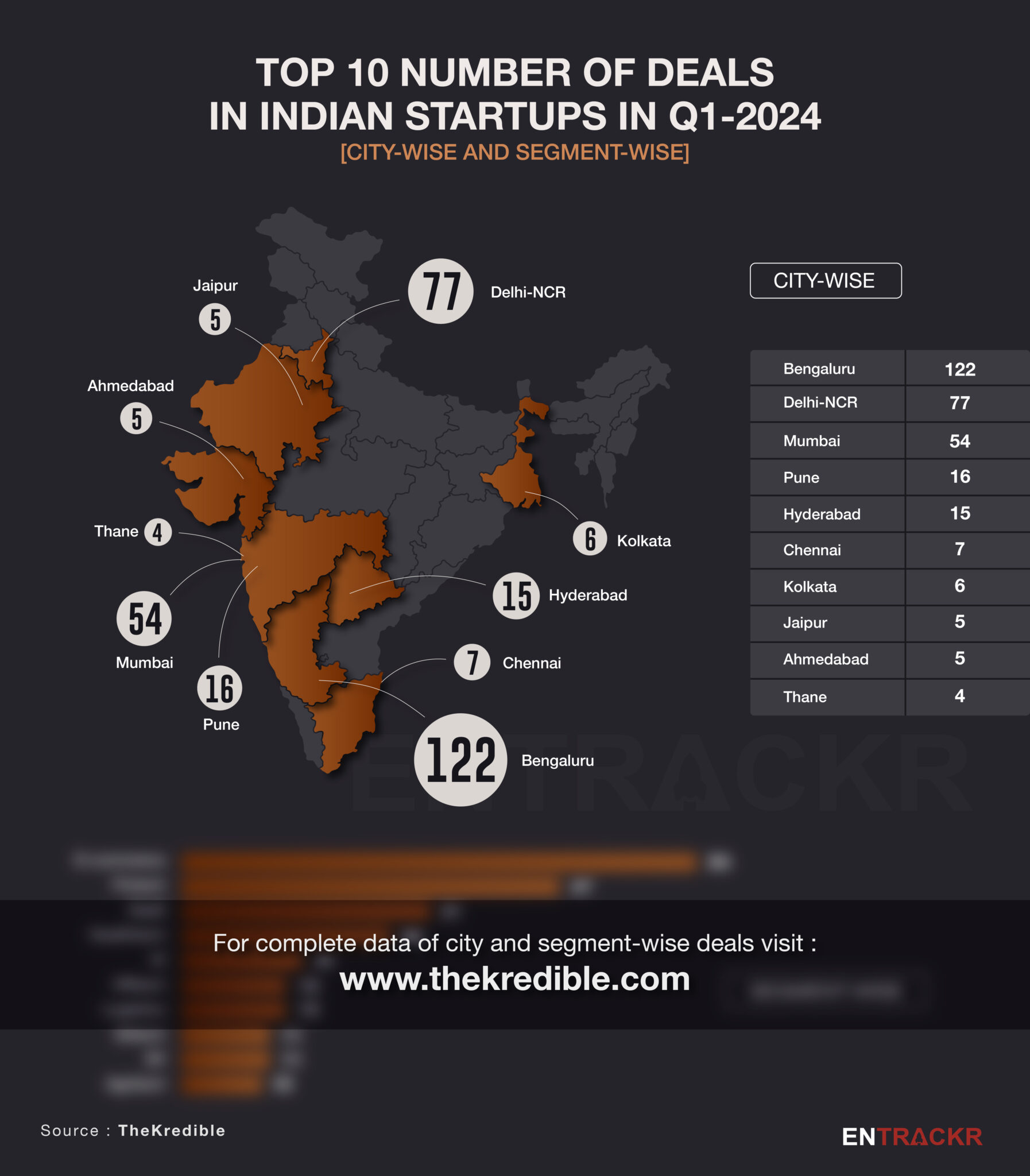

[City and segment-wise deals]

City-wise, Bengaluru-based startups remain on top with 122 deals, contributing around 54% of the overall funding in the first quarter of 2024. Delhi-NCR and Mumbai followed with 77 and 54 deals, respectively. The list further counts Pune, Hyderabad, Chennai, Kolkata, Jaipur, Ahmedabad, and Thane among others.

Segment-wise, e-commerce startups (including D2C brands) led the list with 64 deals followed by fintech (47), healthtech (31), SaaS (26), EV (15), AI (13), and edtech (13) startups. The complete breakdown of the city and segment can be found at TheKredible.

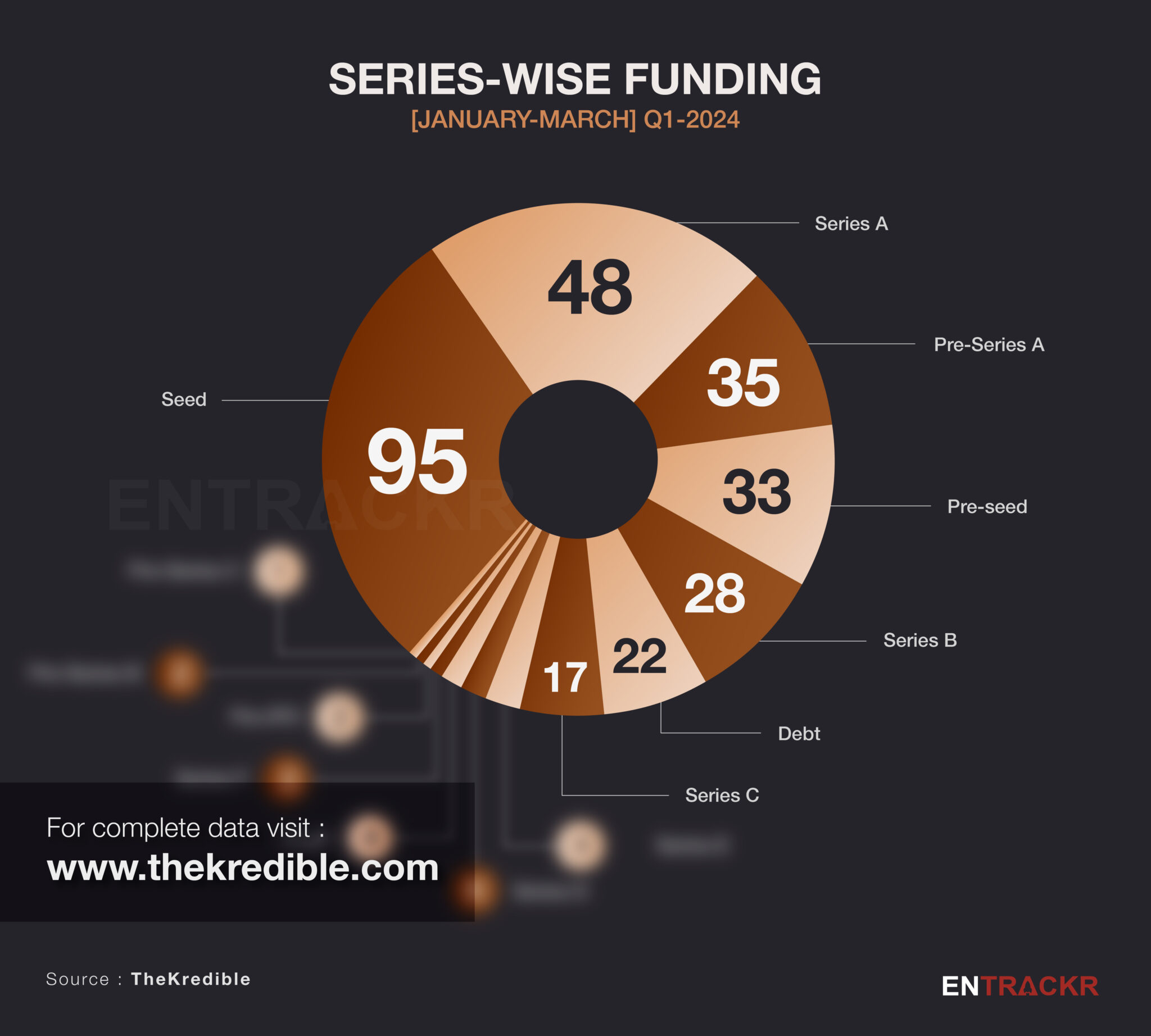

[Stage-wise deals]

Series-wise, 95 startups raised funding in Seed round followed by 71 Series A, 35 Pre-Series A, and 33 Pre-seed deals. Among early-stage, as many as 4 startups raised funding in their angel round. While 22 startups raised debt funding worth $276.65 million during the period.

[Most active investors]

Early-stage venture capital firm Inflection Point Ventures and Blume Ventures have emerged as the most active investors in Q1 2024 with 11 and 10 investments, respectively. Venture Catalysts was next on the list with nine deals followed by Fireside Ventures, Anicut, Accel, and Stride Ventures. The full list can be found at TheKredible.

[Mergers and acquisitions]

The first quarter of 2024 registered 26 merger and acquisition deals. Acquisition of Tapasya Educational Institutions by Veranda, InSemi by Infosys, Qdigi Services by Onsitego were the top 3 disclosed mergers and acquisitions deals. During the period, listed gaming firm Nazara’s subsidiary Nodwin acquired two startups: Comic Con India and Ninja Global FZCO.

Among the undisclosed deals, Kuvera was acquired by fintech unicorn CRED, Captain Fresh took over CenSea while OneVerse acquired three startups including Spartan Poker, BatBall11, and Calling Station. Check the full list here.

[Layoffs, shutdowns and departures]

Layoffs continued in the March quarter as more than 1,100 employees received pink slips. Among them, foodtech company Swiggy topped the list with laying off of 350 employees followed by Cult.fit, InMobi, and Pristyn Care with 150, 125 and 120 employees, respectively.

During the first quarter, five companies shut their operations. The list includes Resso, Rario, OKX India, GoldPe, and Muvin. Rario, however, added that it will launch a brand new platform that will enable users to play new and engaging cricket-based games.

Besides layoffs and shutdowns, nearly two dozen top-level executives hung up their boots. Vijay Shekhar Sharma, founder of Paytm Payments Bank, resigned as the part-time non-executive chairman and board member of the company. Meanwhile, Third Wave Coffee’s chief executive officer Sushant Goel stepped down from his position to become a board member. The list also includes Indus Appstore CEO Rakesh Deshmukh, DealShare’s co-founder Sourjyendu Medda, and Fashinza’s co-founder Jamil Ahmed.

[ESOP buyback]

Amid all the ups and downs, the startup ecosystem witnessed employees stock buyback by growth and late-stage companies. For context, e-commerce company Meesho rolled out its largest ESOP buyback worth $25 million for 1,700 employees. Community management app MyGate and edtech company Classplus also announced their employee stock buyback program earlier this year. The full list can be found here.

Visit TheKredible to see series-wise deals along with amount breakup, complete details of fund launches, and more insights.

[Conclusion]

As funding revives, it is safe to say that the trend in layoffs will also subside in the coming months, if not weeks. The strength in fintechs continues, and the category will continue to seek more money and throw up the next big startups, as scale arrives faster for many. Newer categories, be it AI, Chip Design, or niche parts of healthtech look set to emerge soon, going by the churning in the markets. The big hope is that the many corporate governance issues that have plagued the ecosystem in the past two years will also take a backseat now, thanks to lessons learnt hopefully. Looking at the numbers, especially for Q1 2022 ($12 billion), many would say that opportunities and capital have been wasted. But that is the very nature of the Startup world, with tiny amounts of money and a dollop of innovation sometimes achieving what no amount of money thrown at a problem doesn’t. We remain optimistic that by Q4 of this year, India’s startup ecosystem will be stronger and more diversified than ever before.

[ad_2]

Source link