[ad_1]

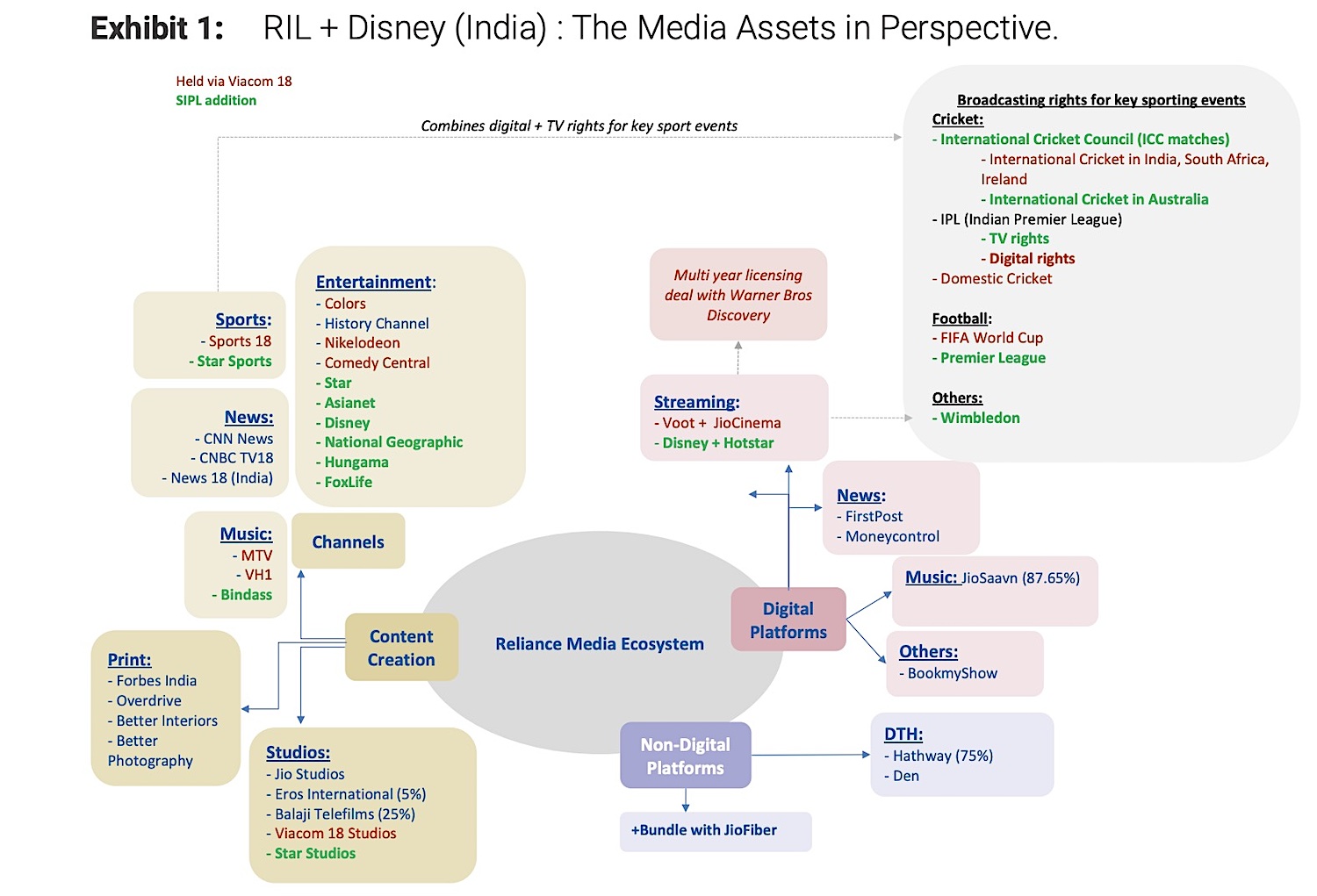

Reliance, its portfolio Viacom18 and Disney are merging their media businesses in India, creating the largest media entity in the world’s most populous nation. Reliance, which will control the joint venture, directly owns 16.34% of the merged entity, which it has valued at $8.5 billion. Disney will own a 36.84% stake in the merged entity, and Reliance-backed Viacom18, which also counts Paramount Global and James Murdoch’s Bodhi Tree among its backers, will own 46.82% stake.

Reliance, which is India’s most valuable firm, said it sees an opportunity to expand and streamline its presence in the Indian fast-growing market by merging its media assets with Disney India. Reliance, which owns about 75% of Viacom18, plans to invest $1.4 billion into the joint venture for its growth strategy.

For Disney, the deal is bittersweet. The firm once valued its India business at about $16 billion and the streaming business Hotstar, which became part of Disney India after the mega Fox acquisition, allowed the U.S. giant to aggressively expand into several Southeast Asian streaming markets.

Furthermore, Disney disclosed in an SEC filing Wednesday that the joint venture will incur a non-cash pre-tax impairment of between $1.8 billion and $2.4 billion, “approximately half of which reflects a write-down of the net assets of Star India,” in the current quarter.

Image: Morgan Stanley

The “strategic” merger of Reliance and Disney India also unites two leading Indian streamers, JioCinema and Disney+Hotstar. The joint venture also includes access to dozens of TV channels that Disney owns and exclusive rights to Disney’s movies and other productions in India, as well as its 30,000 additional assets. Between JioCinema and Hotstar, the merged entity will also be the digital home to content from HBO, Showtime and NBCUniversal.

The combined unit will reach over 750 million viewers across India, the firms said. The new venture comes at a time when large media giants are struggling in India. Sony called off the merger between its India unit and Zee Entertainment last month, ending a two-year acquisition deliberation that would have created a $10 billion media powerhouse in the South Asian market.

Reliance chairman Mukesh Ambani, who also happens to be Asia’s richest person, said the deal with Disney “is a landmark agreement that heralds a new era in the Indian entertainment industry.”

He added: “We have always respected Disney as the best media group globally and are very excited at forming this strategic joint venture that will help us pool our extensive resources, creative prowess, and market insights to deliver unparalleled content at affordable prices to audiences across the nation. We welcome Disney as a key partner of Reliance group.”

The merger follows a fierce competition between Hotstar and JioCinema, which lured top Disney talent last year to boost its platform. Viacom18 also outbid Disney’s $3 billion for five-year streaming rights to India’s popular cricket tournament, the Indian Premier League, breaking many of Hotstar’s past viewing records in just one year. Disney paid the same amount for the TV rights. To lure users, both the firms have been streaming much of their catalogs at no cost in India.

The combined new entity captures both digital and TV rights of key cricket sporting events in India, like IPL and ICC matches. The 2023-27 IPL broadcasting now sit under the JV – Viacom18 has digital streaming rights while Star has TV broadcasting rights.

Disney CEO Bob Iger said the joint venture will “create long-term value for the company.” He added: “Reliance has a deep understanding of the Indian market and consumer, and together we will create one of the country’s leading media companies, allowing us to better serve consumers with a broad portfolio of digital services and entertainment and sports content.”

The merger also reunites former Star India CEO Uday Shankar and James Murdoch with the business they previously built for a decade — Shankar departed Star India after 2020 disputes with Disney; then he and Murdoch launched Bodhi Tree, an India media investment vehicle backed by $1.7 billion from Qatar Investment Authority, which invested over $500 million in Viacom18. Shankar now returns as vice chair of the merged entity’s board.

The merger is subject to regulatory and shareholder approval and the two firms expect it to complete by the end of March 2025.

The story was updated throughout with additional details.

[ad_2]

Source link

Its like you read my mind You appear to know so much about this like you wrote the book in it or something I think that you can do with a few pics to drive the message home a little bit but other than that this is fantastic blog A great read Ill certainly be back