[ad_1]

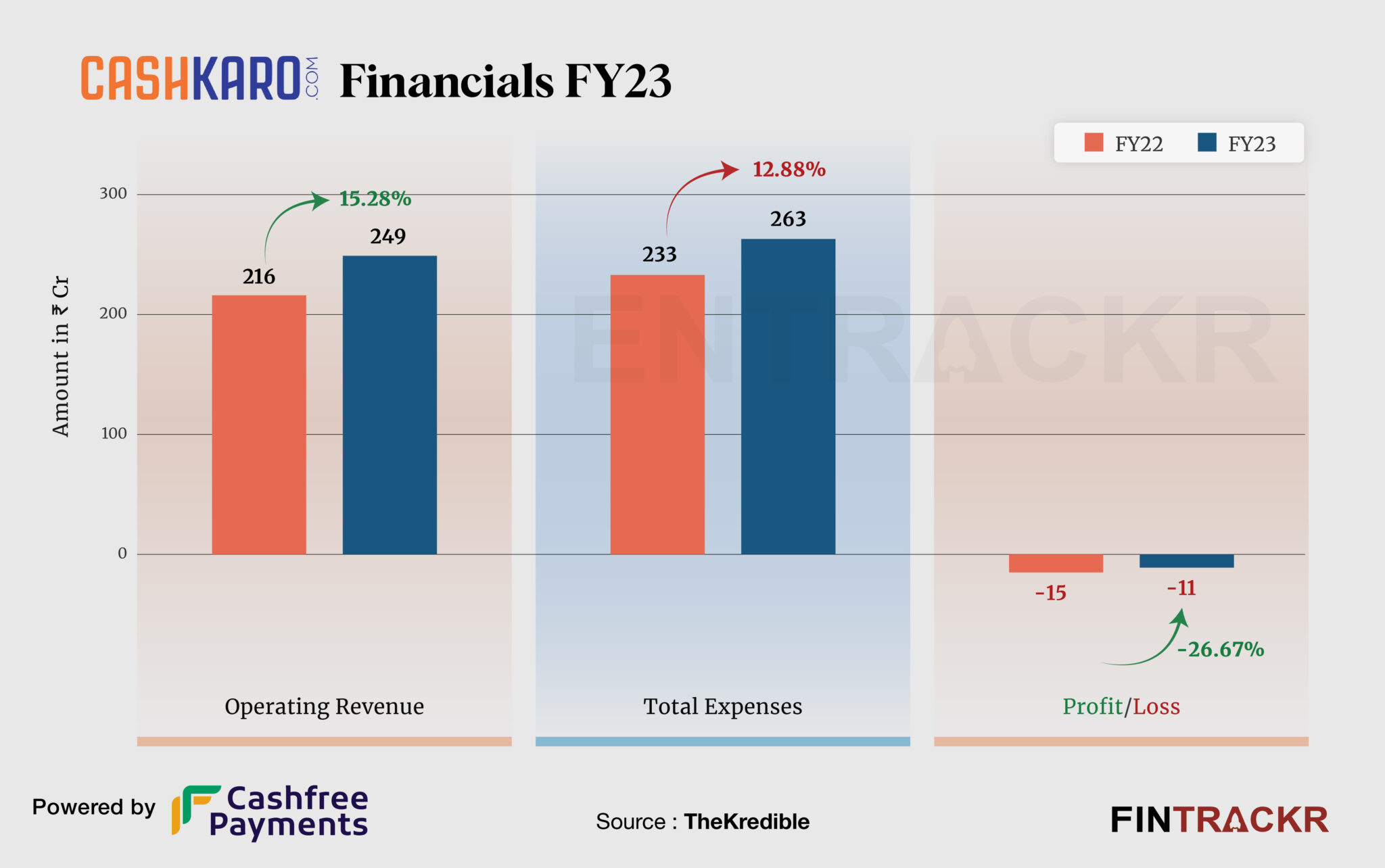

Following an impressive twofold increase in scale during FY22, cashback and coupons app CashKaro moderated to just 15.28% growth during the fiscal year ending March 2023. At the same time, losses for the Ratan Tata-backed company declined 26%.

CashKaro’s revenue from operations increased by 15.28% to Rs 249 crore in FY23 from Rs 216 crore in FY22, its consolidated annual financial statements filed with the Registrar of Companies show.

B2C brand CashKaro—through its apps like CashKaro, EarnKaro, CashKaro Stores, and BankKaro—offers coupons, price comparisons, and deals to consumers and enables its members to earn cashback and rewards for online shopping. The income from its platform services was the primary source of revenue for CashKaro.

It has over 1,500 e-commerce brands including horizontals like Amazon, Flipkart, and Myntra to vertical leaders like Mamaearth, boAt, Tata 1mg and Nykaa. The firm claims that it recorded gross merchandise value (GMV) of Rs 4,500 crore during FY23 and attributed the growth to expansion of new categories, ad campaigns, and uptick in sales of mobiles and electronics and surge in travel bookings.

Being a cash-back provider firm, the cost of cashback offered to the customers is naturally the largest cost center accounting for 52% of the overall expenditure. Although, surprisingly it marginally declined to Rs 137 crore in FY23 from Rs 140 crore in FY22.

- Purchase of e-vouchers

- Employee benefit

- Advertising promotional

- Cashback

- Store service fee

- Others

Advertising and promotion was the second largest cost which increased by 20.8% to Rs 58 crore in FY23. Its employee benefits, store service, purchase of e-vouchers, and other overheads took the total expenditure up by 12.88% to Rs 263 crore in FY23 from Rs 233 crore in FY22.

Check TheKredible for a detailed expense breakup.

Even with a modest scale, the company managed to control its cost which led to its losses to decline by 26.67% to Rs 11 crore in FY23 as compared to Rs 15 crore in FY22. Its ROCE and EBITDA margin improved to -6.4% and -2.8% respectively.

| EBITDA Margin | -7% | -2.8% |

| Expense/Rupee of ops revenue | ₹1.08 | ₹1.06 |

| ROCE | -28% | -6.4% |

On a unit level, it spent Rs 1.06 to earn a rupee in FY23.

For FY24, the firm is targeting a 30-40% jump in revenue to Rs 350–375 crore. CashKaro has raised over Rs 250 crore since its inception from investors like Kalaari Capital, Ratan Tata, Korea Investment Partners and Affle Global Pte Ltd.

With its affiliate marketing driven model that has added some unique features of its own, CashKaro will find margin improvement the biggest challenge at all times, as we do not yet know which partners dominate its take. Any commission reduction by those partners will naturally affect the firm, leaving it hostage to uncertainties in the future as well. On top of that is a fast evolving market for affiliate selling, where it has to stay on top of the trends or miss out. Quite simply, this is a model that is forever on the treadmill, and founder fatigue is the biggest risk here.

[ad_2]

Source link