[ad_1]

In today’s business world, every dollar counts for more than ever before. The current economic downturn, funding crunch, and race to be cash-flow positive are forcing organizations to reevaluate budgets and spending patterns. This has pushed CFOs to issue mandates — cut software spend between 10% and 30%.

Based on data available from my company’s platform, spend on software is now the third-biggest expense for organizations, right after employee and office costs.

CFOs must work closely with CIOs and department heads to devise smart plans to cut their SaaS spend and get more bang for their buck. At the same time, reducing software spend should not negatively impact company growth or inhibit innovation.

The primary objective for CFOs should be to identify where they’re spending, recognize departments with the highest costs, and identify instances of low utilization and application redundancies.

I think the right approach to cutting SaaS spend involves a data and metric-driven strategy. Understanding the ROI for each vendor and evaluating the SaaS spend per employee will enable the CFOs and CIOs to identify the software’s true value and how quickly it will add to the company’s top and bottom line. Spend analysis will empower you to make informed choices regarding cost optimization.

What does typical software spend in organizations look like?

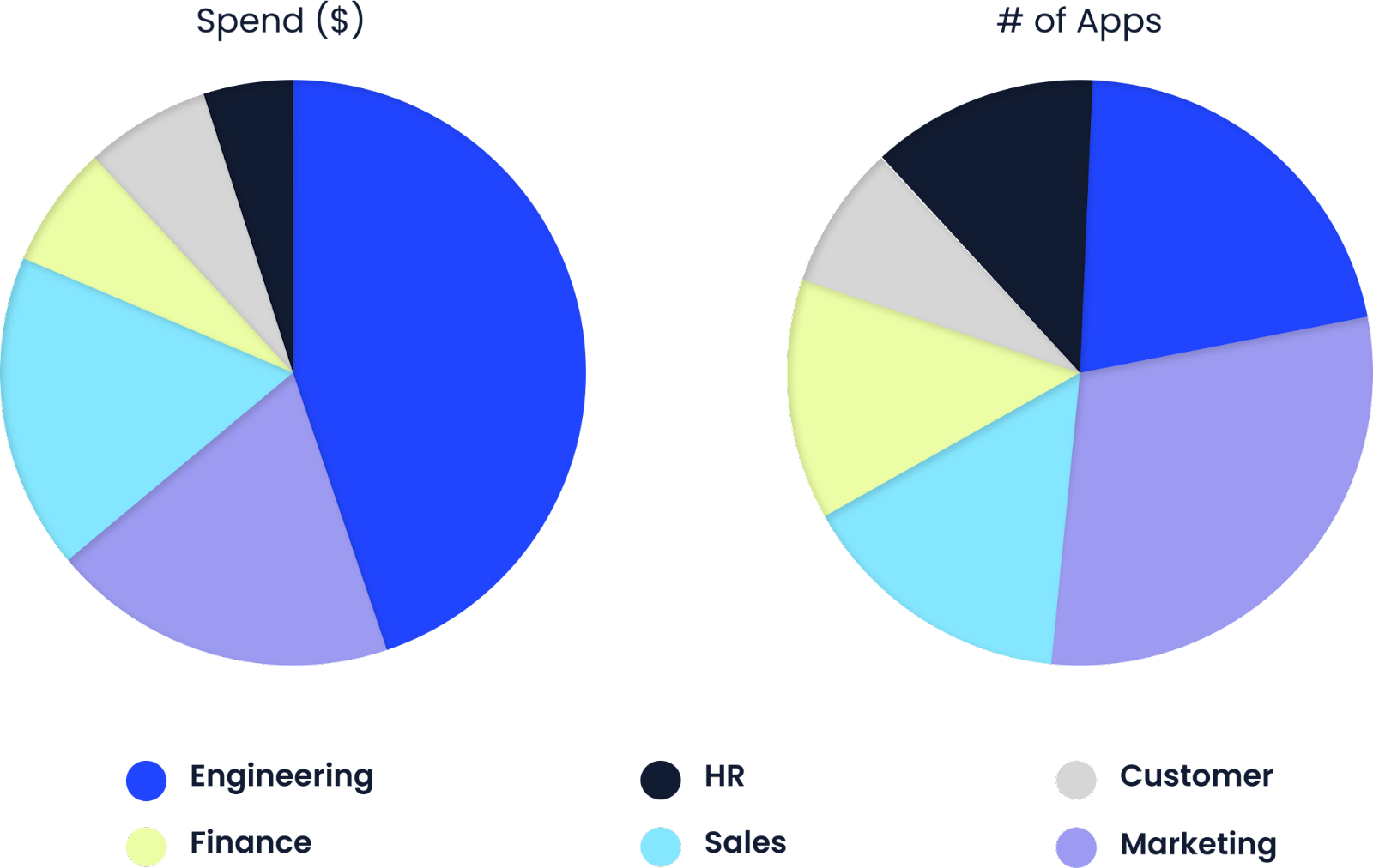

Our data indicates that the engineering department spends the most, followed by marketing and sales, and then HR. While the engineering department tops spend by dollars, it’s not the department with the highest number of SaaS applications. That distinction goes to the marketing team.

Image Credits: CloudEagle’s database

So, should we ask the department that spends the most to reduce spending?

Software is now the third-biggest expense for organizations, right after employee and office costs.

Maybe yes, but let’s look at the low-hanging fruit first — sales and marketing teams have the highest count of abandoned and underutilized apps.

Sales and marketing teams must adapt quickly to changes in the market and evolving customer requirements; they often acquire different tools to meet their immediate demands, and when those requirements shift, they frequently transition to new tools, leading to low utilization and redundant tools.

Secondly, CFOs can use benchmark data to ensure their spend aligns with similar-sized companies. Depending on the size of the company and the employee’s department, companies spend an average of $1,000 to $3,500 on software tools per employee. CFOs must collaborate with teams to optimize the buying process and control spending. If your company’s spend does not meet the typical benchmarks of peers, it might be good to investigate why.

[ad_2]

Source link