[ad_1]

Recykal, a B2B marketplace for waste management, has transitioned its topline from Rs 61 crore in FY20 to Rs 745 crore in FY23 with over 12X growth. However, the Hyderabad-based startup slipped into losses during FY23.

Recykal’s gross revenue grew 3.9X to Rs 745 crore during the fiscal year ending March 2023 as compared to Rs 190.5 crore in FY22, according to the company’s consolidated financial statements with the Registrar of Companies.

Founded in 2017, Recykal is an end-to-end digital solutions provider for waste management. It helps businesses fulfill their EPR targets, become plastic neutral, dispose of IT assets, source recyclable materials, and track and trace industrial waste flow. Recykal’s solutions include ERP, plastic neutrality, ITAD, marketplace, and circularity. These solutions help businesses to reduce their environmental impact and create a more sustainable future.

The company collected 88% of its operating revenue from the sale of waste/scrap goods. These collections jumped 5.2X to Rs 656.5 crore during FY23 from Rs 125.8 crore in FY22.

Revenue from the sale of extended producer responsibility certificates went up 37% to Rs 88.5 crore in FY23 from Rs 64.6 crore in FY22. The company also received a grant/donation worth Rs 5 lakh during the fiscal year.

Besides this, it earned Rs 2.53 crore as interest and gains on financial assets during FY22, taking the overall revenue to Rs 747.6 crore.

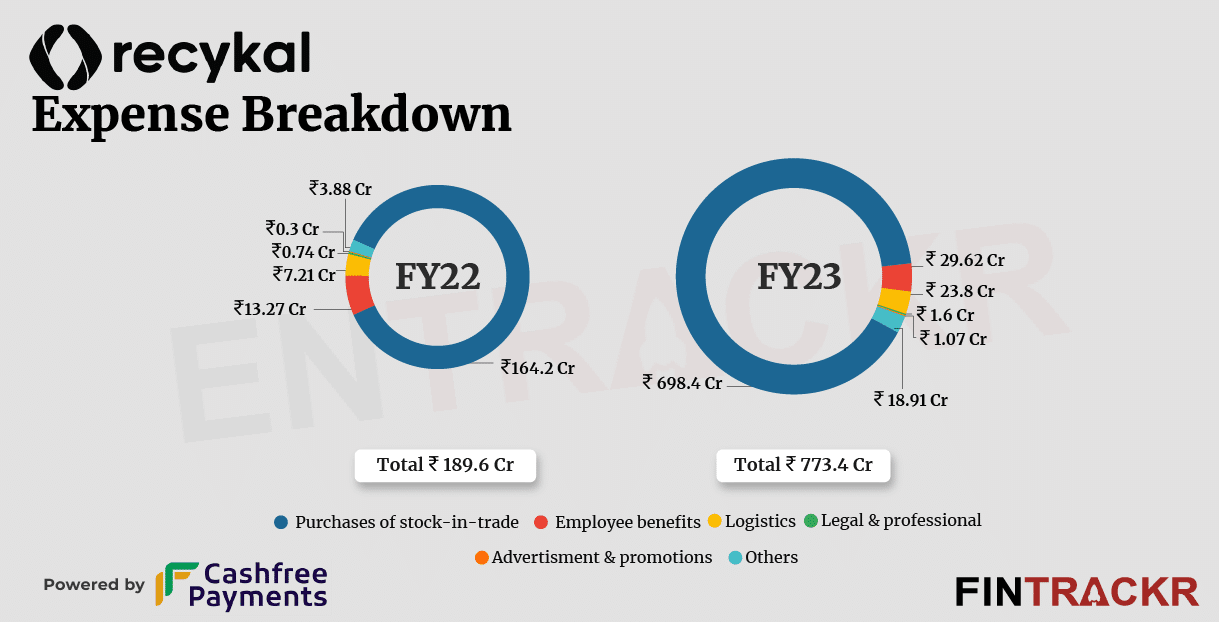

Purchases of stock-in-trade was the largest contributor (90.3%) to the total expenses of the company. In line with scale, this cost surged over 4X to Rs 698.4 crore in FY23 from Rs 164.2 crore in FY22.

Employee benefits expenses inclined 123% to Rs 29.62 crore during the fiscal. This cost also includes employee stock option expense of Rs 1.85 crore.

Further, logistics, legal, and promotional expenses spiked 3.3X, 2.1X and 3.5X respectively to Rs 23.8 crore, Rs 1.6 crore and Rs 1.07 crore during FY23. At the end, the company’s total expenditure soared 4X to Rs 773.4 crore in FY23 in comparison to Rs 189.6 crore in FY22.

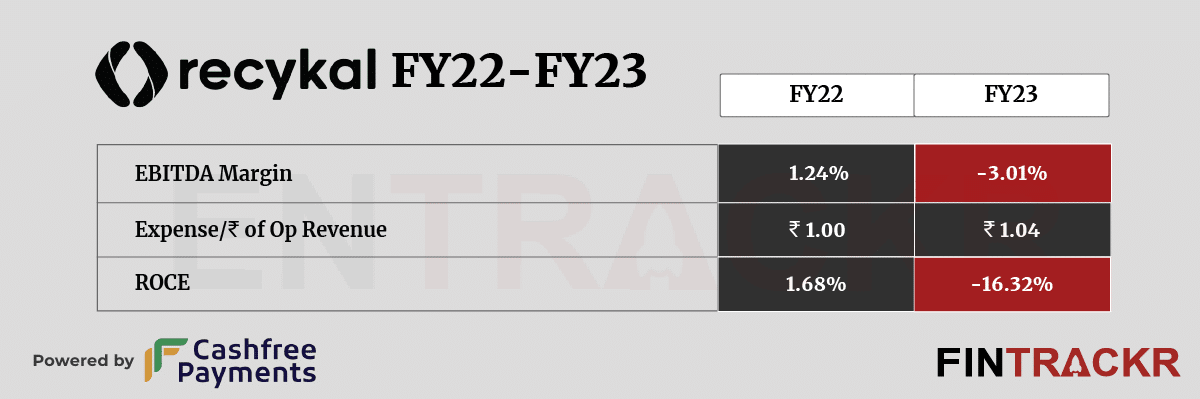

Following the rising expenditure, Recykal’s bottomline slipped into red. The company posted Rs 25.8 crore loss in FY23 against Rs 1.26 crore profits in FY22. The cash burn can also be observed from the company’s operating cash outflows which jumped 3.7X to Rs 64.6 crore during the last fiscal year.

As per Fintrackr’s analysis, Recykal’s EBITDA margin and ROCE worsened to -3.01% and -16.32% in FY23. On a unit level, the company spent Rs 1.04 to earn a rupee of operating revenue.

Recykal has raised around $26 million or Rs 184 crore to date from the likes of Morgan Stanley, Circulate Capital, Triton, and Bank of Singapore among others. Lastly it raised $22 million or Rs 162 crore in Series A round during January 2022.

The waste management business is finally getting the attention it deserves, and policy moves will also support growth, as stricter norms are implemented. However, it also has some very well established firms already, and more are bound to come in. Recykal is well placed to leverage its experience as a digital platform that offers a marketplace and more to stakeholders. The opportunity is massive, as one would expect in an economy India’s size, and there is every possibility that Recykal will eventually spread out like the global supply chains it seeks to clean up.

[ad_2]

Source link