[ad_1]

Temu has set up U.S. warehouses for sellers on its growing marketplace to offer faster delivery.

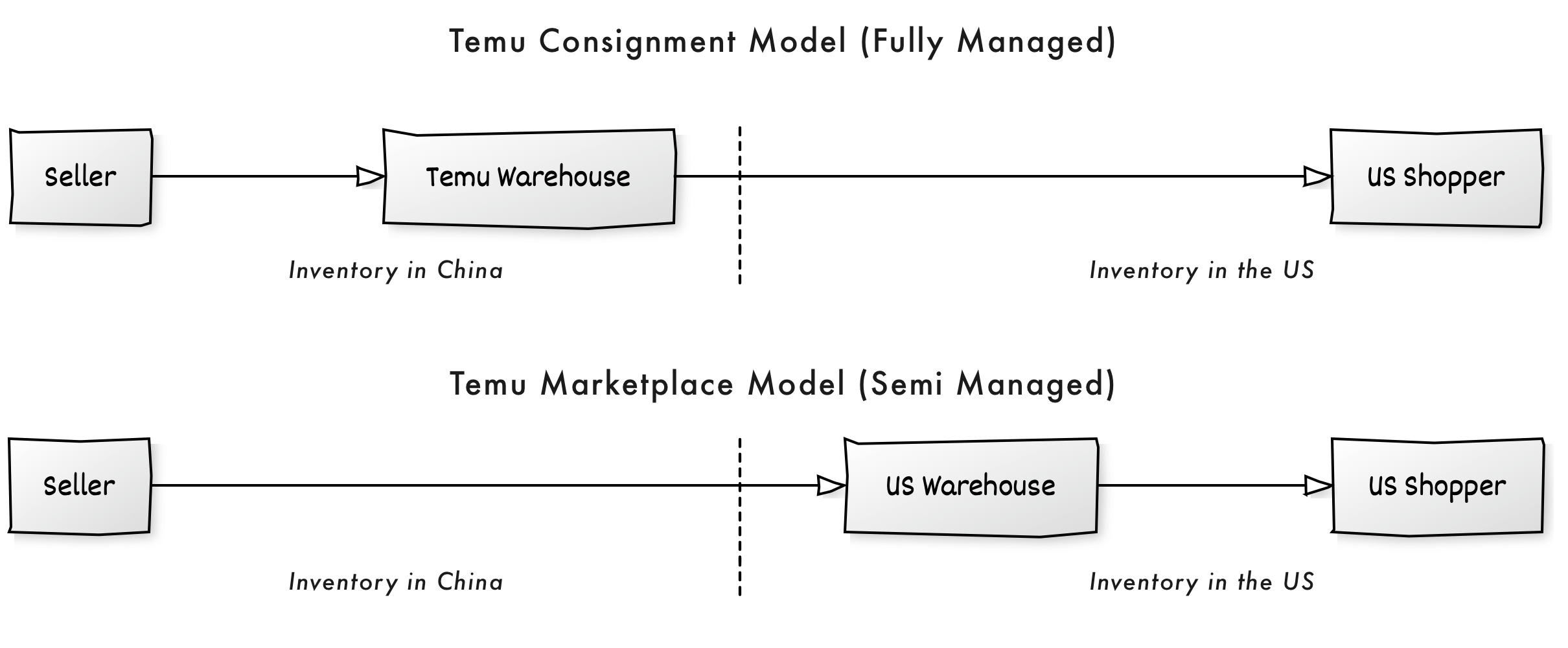

Thirty days ago, Temu launched a marketplace to increase the supply of goods with faster delivery. Previously, each order shipped from China, and despite using air freight and other optimizations, it typically took a week to reach the shopper. Temu’s new marketplace is for sellers with inventory already in the U.S. (or Europe, or elsewhere Temu operates). They can deliver goods significantly faster than a week.

Amazon has Fulfillment by Amazon (FBA), and Walmart has Walmart Fulfillment Services (WFS), allowing sellers to offload warehousing and fulfillment. Temu has now done the same, albeit without the massive buildout cost — it has partnered with WINIT (万邑通) and Easy Export (出口易) to offer the service. Both have issued announcements recently. Those firms have existing warehouses in the U.S. and elsewhere and will effectively act as FBA/WFS of Temu. Sellers will ship inventory in bulk to WINIT (万邑通) and Easy Export (出口易) warehouses in the U.S., and from there, goods will get shipped to shoppers.

According to Marketplace Pulse research, Temu’s marketplace already has 5,000 sellers. All Temu’s sellers are based in China; it hasn’t started seller recruitment elsewhere and, for now, appears to require sellers to be based in Hong Kong or China. Temu’s new fulfillment partners likely do little business with sellers outside of China, too. The partnerships will accelerate marketplace growth before it eventually opens up to U.S. sellers and brands.

Most goods on Temu are sold using a consignment model that requires manufacturers to agree on wholesale pricing and ship goods in bulk to Temu’s processing warehouses in China. Temu then handles the listing, marketing, fulfillment, customer service, and pricing and pays the seller once someone orders their product. This model gave Temu control over quality, selection, and pricing but prevented it from onboarding sellers from other countries.

Shein, Temu’s close rival, has been setting up warehouses closer to shoppers for over a year. It imports its best-sellers in bulk and sells them with the “QuickShip” option. It doesn’t offer space in those warehouses to its sellers (it has been operating a marketplace for nearly a year). Both companies are creating two assortment tiers: local inventory with an advantage in shipping speed and direct-from-China inventory with an advantage in price, selection size, and frequency of change.

Temu’s marketplace is reducing its reliance on duty-free shipments enabled by the de minimis threshold ($800 in the U.S.) and growing inventory with faster delivery. Even if that faster delivery makes those goods closer in price to Amazon while also losing assortment agility. But it’s not diversifying from its primary source of goods — China.

[ad_2]

Source link