[ad_1]

British International Investment-backed fintech platform WeRize seems to have found a stable ground across smaller cities and this could be validated from its growth trajectory in the last two fiscal years. The five-year-old firm registered staggering 22X growth in its operating scale which rose to Rs 68.14 crore in FY23 from Rs 3.2 crore in FY21.

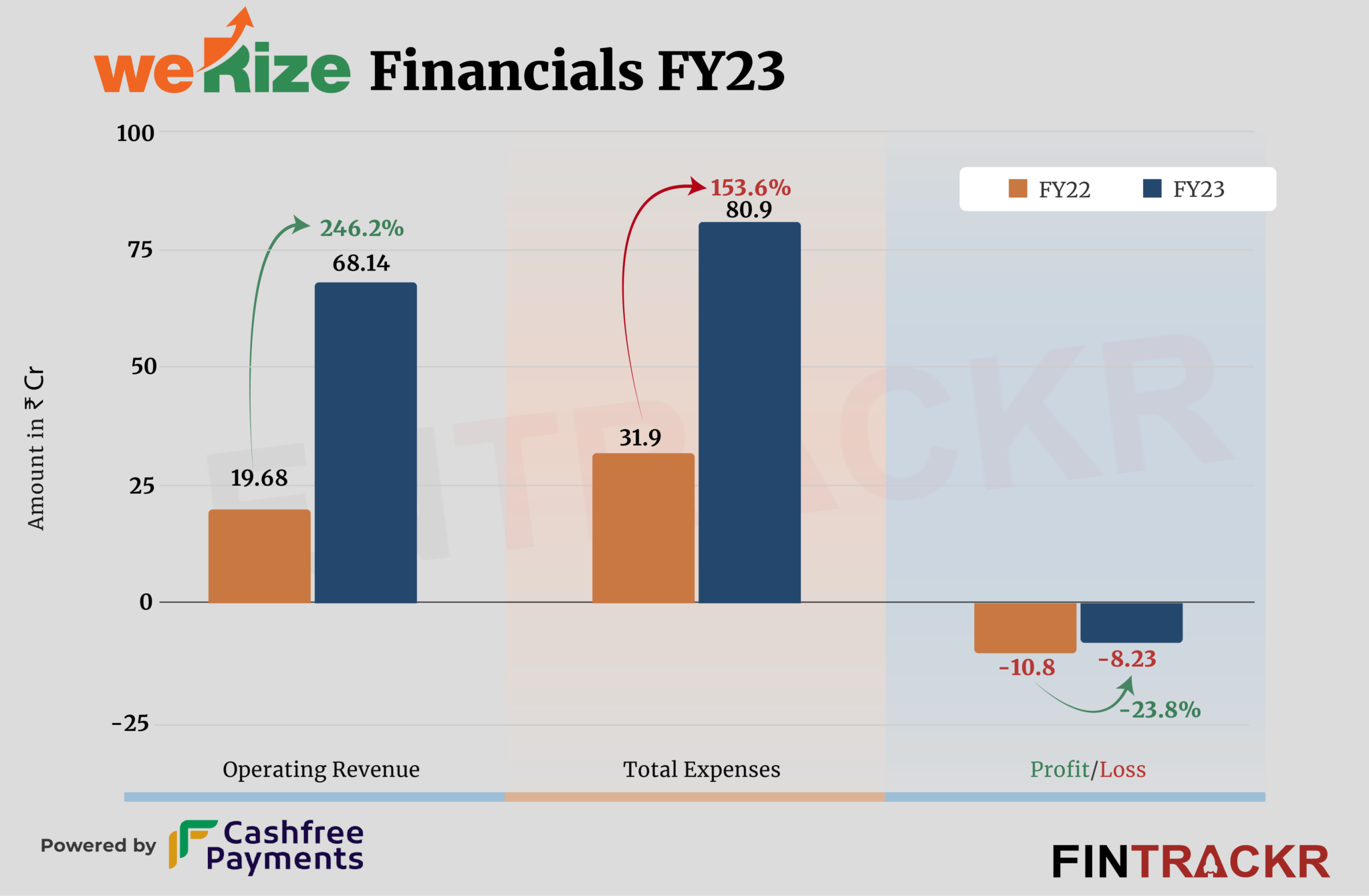

When it comes to year-on-year growth, WeRize revenue from operations spiked 3.46X to Rs 68.14 crore in the fiscal year ending March 2023 from Rs 19.68 crore in FY22, its consolidated financial statements sourced from the Registrar of Companies shows.

Founded by Sachin Chopra and Himanshu Gupta, WeRize provides loans (mortgage and unsecured), group insurance to lower middle class through its own (Wortgage Finance) and third party non-banking financial institutions including Vivitri capital and InCred.

Revenue from interest and services fees accounted for 84.85% of the total operating revenue. It earned Rs 33.49 crore from interest while service fee aka loan processing fee brought Rs 24.33 crore to the company’s coffers. WeRize also made Rs 4.63 crore from non-operating activities, pushing its total income to Rs 72.77 crore in FY23.

Similar to most of the lending startups, employee benefit expense formed 34.98% of the overall expenditure which increased by 125.9% to Rs 28.3 crore in FY23 from Rs 12.53 in FY22.

WeRize’s professional consultancy fees, commission, subscription fees, performance payouts, and other overheads took its overall expenditure up by 153.6% to Rs 80.9 crore in FY23 from Rs 31.9 crore in FY22.

Head to Thekredible for detailed expense breakup.

- Professional and consultancy fee

- Employee Benefit

- Commission

- Subscription and membership fees

- Performance guarantee payouts

- Others

Despite a 2.5X surge in expense and increase in revenue, the company managed to cut its losses by 23.8% to Rs 8.23 crore in the last fiscal year. Its ROCE and EBITDA margin also demonstrated improvement significantly to -2% and 2.5% respectively. On a unit level, it spent Rs 1.19 to earn a rupee in FY23.

| EBITDA Margin | -29% | 2.5% |

| Expense/₹ of Op Revenue | ₹1.62 | ₹1.19 |

| ROCE | -13% | -2% |

According to the startup data intelligence platform TheKredible, WeRize secured $15.5 million in funding in June 2022 at a post money valuation of $108 million. Kalaari Capital holds 16.09% in the firm while 3one4 Capital and Orios Venture Capital hold 13.46% and 10.18%, respectively.

[ad_2]

Source link