[ad_1]

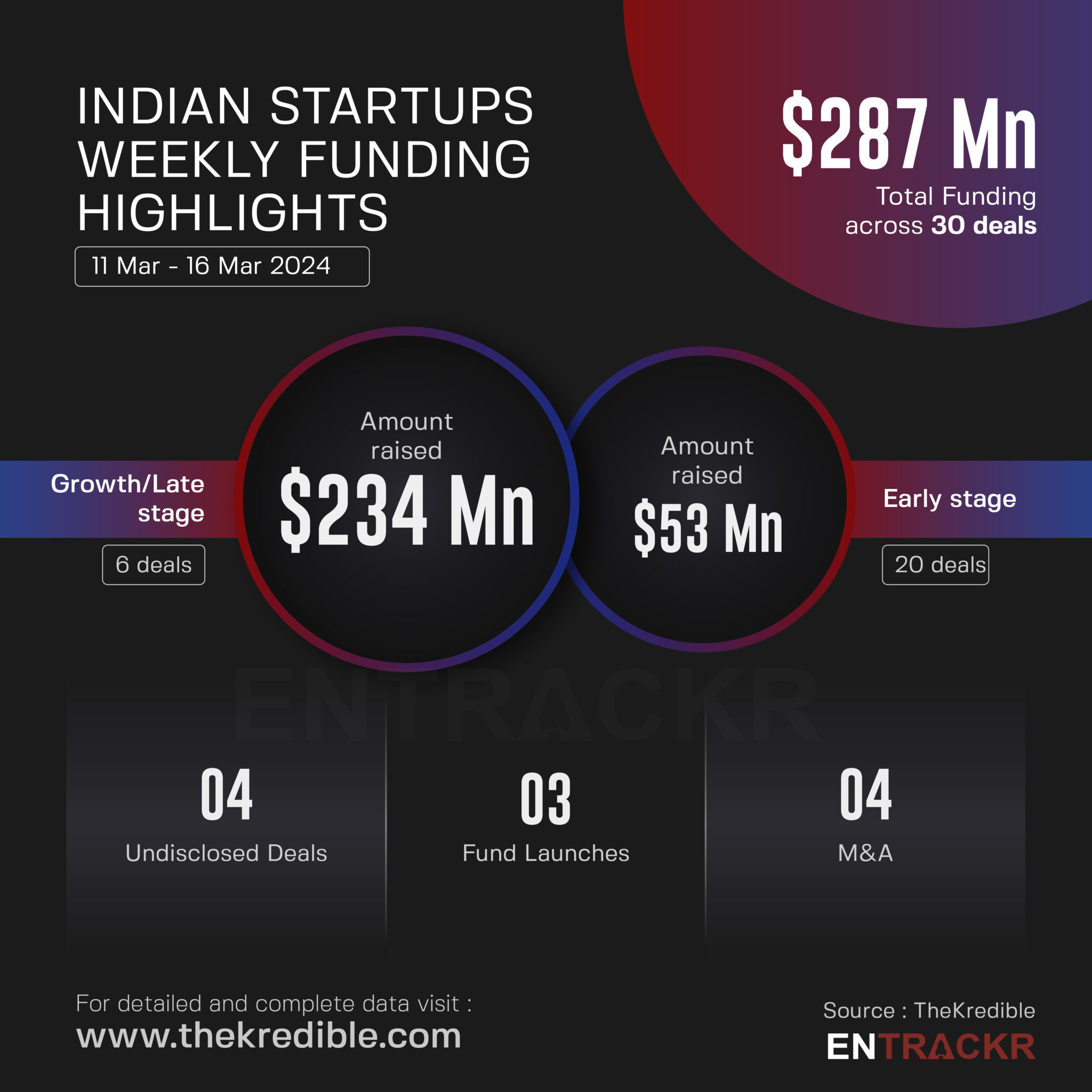

The second week of March saw 30 startups funding deals worth $287 million. These deals include six growth-stage deals and 20 early-stage deals. While one growth and three early-stage startups kept their transaction details undisclosed.

Last week, about 27 early and growth-stage startups collectively raised over $307 million, including three undisclosed deals.

[Growth-stage deals]

Among the growth-stage deals, six startups raised $234 million in funding this week. SaaS-based B2B fintech firm Perfios led the pack with $80 million in funding and turned unicorn. Battery tech startup Lohum, healthtech data analysis firm HiLabs, and AI-based workflow automation platform Nanonets followed the list with $54 million, $39 million, and $29 million funding.

Further, D2C beauty and personal care brand CureSkin and alternative credit platform BlackSoil also secured funding this week. Medical device maker S3V Vascular did not disclose the funding details.

[Early-stage deals]

As many as 20 early-stage startups scooped funding worth $53 million during the week. Debt relief platform FREED topped the list followed by E2E business guide provider RapidCanvas, geriatric care service provider Kites Senior Care, D2C bottled water brand Clear Premium Water, and type 2 diabetes and prediabetes focused platform Sugar.fit.

The list further includes a provider of smart metering solutions for power distribution Kimbal Technologies, fintech startup TapFin, provider of mortgage finance LoanKuber (Janasha Finance), Binny Bansal-led end-to-end solutions provider to e-commerce firm OppDoor, and brand analytics platform GobbleCube among others.

The list of early-stage startups also includes two that kept the amount undisclosed. The startups are The Quorum Club, Indicold, and IntelloSync. For more information, visit TheKredible.

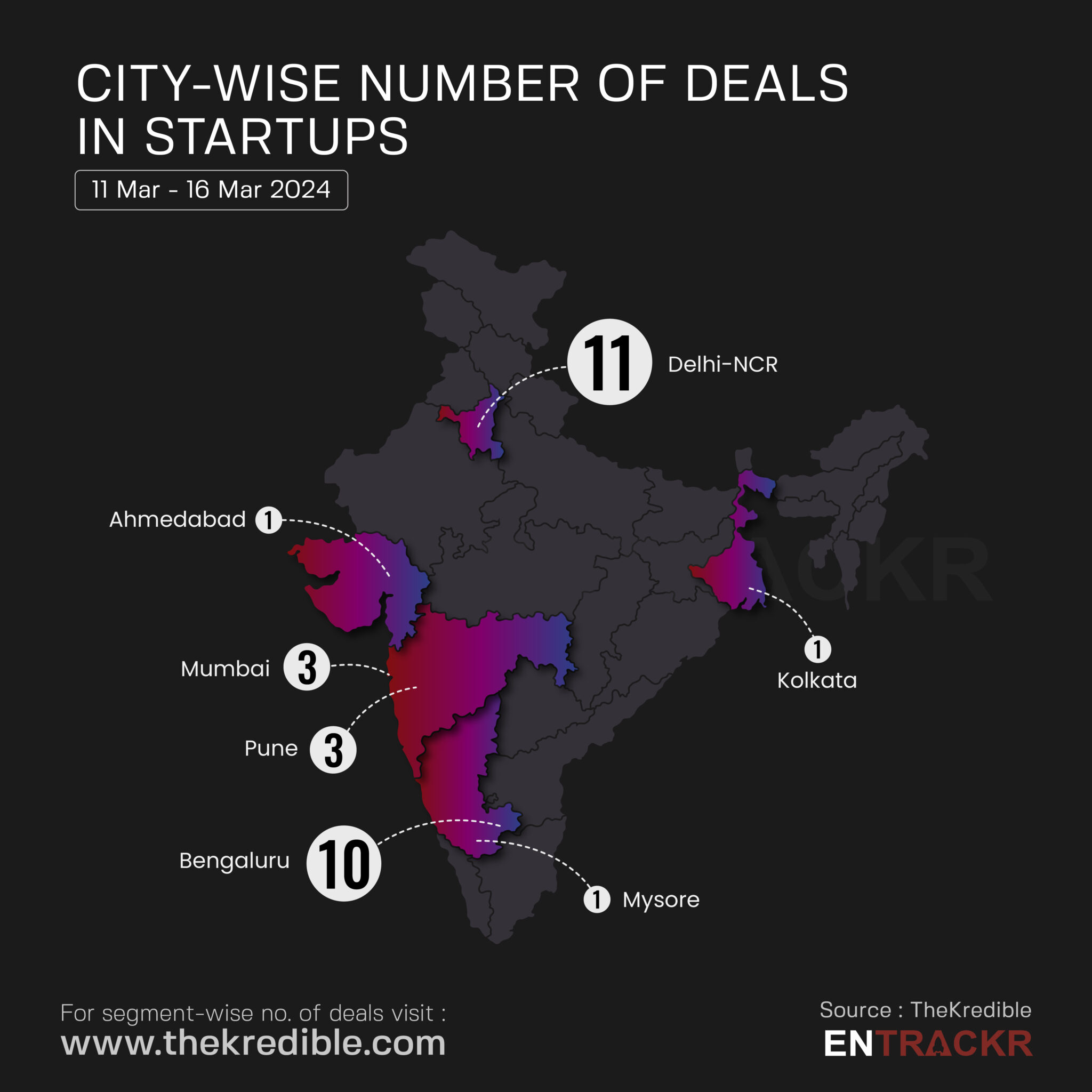

[City and segment-wise deals]

In terms of the city-wise number of funding deals, Delhi-NCR-based startups led with 11 deals followed by Bengaluru with 10 deals. Pune, Mumbai, Ahmedabad, Kolkata, and Mysore are next on the list.

The complete breakdown of the city and segment can be found at TheKredible.

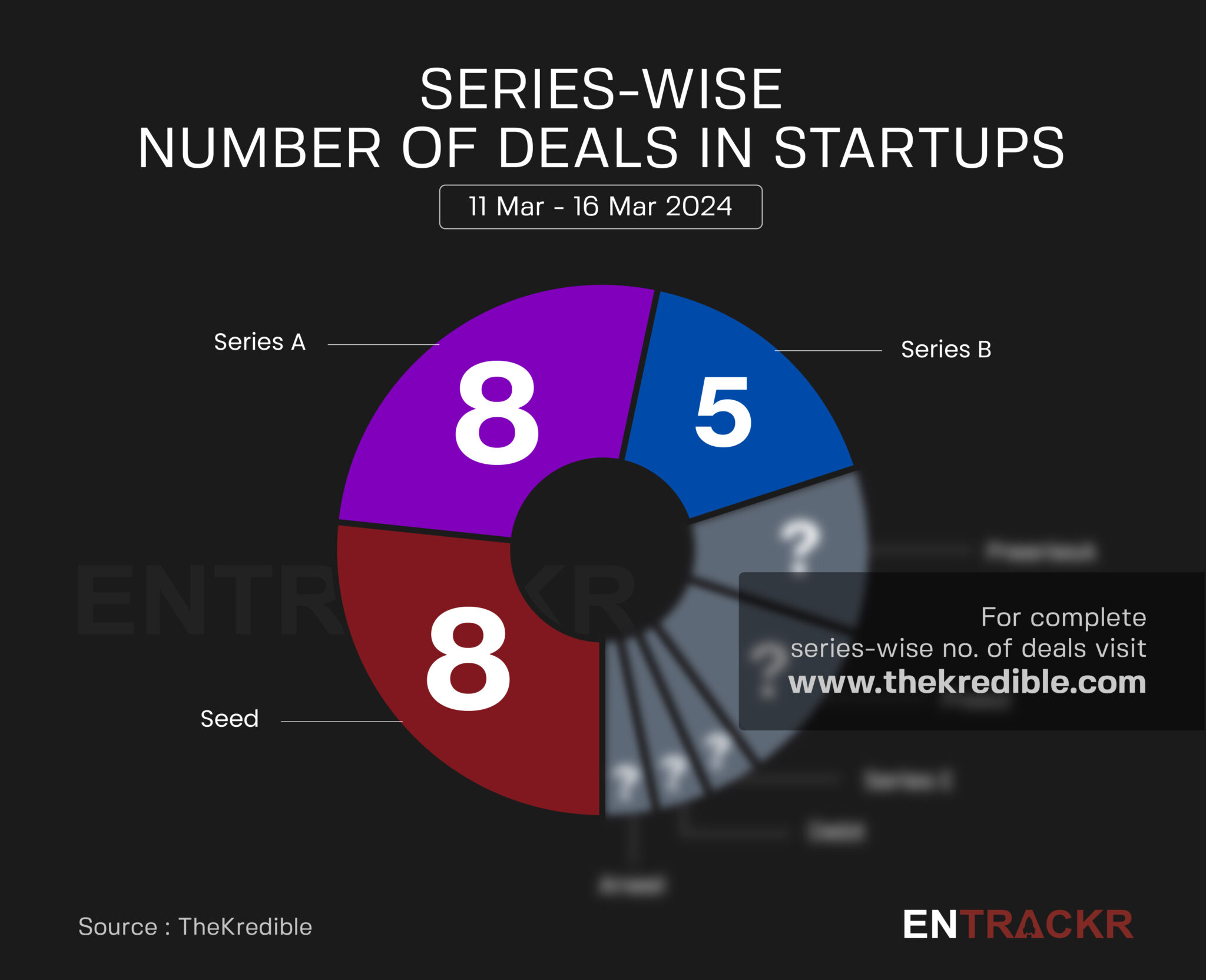

[Series-wise deals]

This week, Seed and Series A funding deals shared the top spot with eight deals each. Five startups raised funding in Series B, followed by three pre-Series A, three pre-Seed, and two pre-seed deals.

[Week-on-week funding trend]

On a weekly basis, startup funding remained somewhat stable at $287 million across 30 deals. Last week, 24 startups raised around $307.8 million in funding.

The average funding in the last eight weeks stands at around $229 million with 27 deals per week.

[Mergers and Acquisitions]

Metaverse and gaming technology platform OneVerse acquired two companies: Calling Station, and BatBall11.

Fast-moving consumer goods (FMCG)-focussed BIA Brands has bought beauty brand Asa Beauty for an undisclosed amount to expand its foothold in the beauty and personal care (BPC) space. While IPO-bound food delivery major Swiggy has reportedly merged its premium grocery vertical InsanelyGood with its quick commerce unit Instamart.

[Fund launches]

The week witnessed three startup-focused fund launches.

Venture capital fund 8i Ventures today announced the launch of ‘Origami’, a seed funding program aimed at supporting early-stage founders.

Prath Ventures has raised Rs 120 crore in a second close co-led by SIDBI Funds and others. The fund will seek to deliver Indian consumption opportunities to its LPs while adhering to the standards of institutional fund management.

Small Industries Development Bank of India (SIDBI) has secured $24.5 Mn from the Green Climate Fund (GCF) for its maiden anchored sustainability and climate focussed fund Avaana Sustainability Fund (ASF).

[ESOP]

Meesho announced the initiation of an employee stock ownership plan (ESOP) buyback program of Rs 200 crore (approximately $25 million), making it the company’s largest ESOP buyback pool to date.

As per a report, CRED also initiated its fourth Accelerated Wealth Programme (AWP) for employees earlier this week, offering employees the chance to purchase additional stock options with an accelerated vesting period.

Visit TheKredible to see series-wise deals and amount breakup, complete details of fund launches, and more insights.

[New launches]

▪️ Magicpin forays into logistics aggregation space, launches Velocity

▪️ CoinSwitch founders to launch an investment platform by June

[Financial results this week]

▪️ FabAlley and Indya-parent posts Rs 185 Cr revenue and Rs 45 Cr loss in FY23

▪️ Toothsi-parent MakeO’s revenue spikes 2X in FY23, posts Rs 220 Cr loss

▪️ Table Space revenue spikes 2X to Rs 780 Cr in FY23; stays profitable

▪️ CoinSwitch’s scale dwindles 82% in FY23; posts Rs 385 Cr loss

▪️ Juspay’s revenue spikes 88% to Rs 213 Cr in FY23; losses stand still

▪️ Decoding the financial health of leading cloud kitchen startups

▪️ KaarTech posts Rs 359 Cr revenue in FY23; remains profitable

▪️ Stanza Living posts Rs 442 Cr revenue and Rs 495 Cr loss in FY23

[News flash this week]

▪️ Paytm gets NPCI nod to become third-party app provider for UPI

▪️ IB Ministry blocks 18 OTT platforms for publishing obscene content

▪️ Swiggy merges InsanelyGood with Instamart

▪️ IPO-Bound Ullu Digital faces complaints for pornographic content

▪️ Classplus named in cheating, forgery case by Abhinay Maths

▪️ Pune RTA rejects the applications of Ola and Uber for aggregator license

▪️ Pocket FM to raise $100 Mn in new funding from Lightspeed

▪️ JioCinema partners with Sharechat and Moj to showcase its sports content

[Entrackr’s analysis]

The weekly funding remained somewhat stable at $287 million across 29 funding deals. In a positive development, Meesho and CRED have reportedly initiated ESOP plans for their employees. Additionally, three VC firms launched startup-focused funds to support Indian entrepreneurs.

Swiggy, the food delivery giant, has merged its premium grocery vertical, InsanelyGood, with its quick commerce unit, Instamart. The move comes as InsanelyGood operations are paused temporarily, with plans to integrate it into the Instamart offering. InsanelyGood, previously a standalone app, was integrated into Swiggy’s main app last year, receiving a separate tile alongside services like Instamart and others. The merger follows a scaling down of InsanelyGood’s operations from six cities to just Bengaluru, aimed at curbing cash burn.

On a different note, Ullu Digital, an IPO-bound streaming platform, is under scrutiny for allegedly selling “pornographic” content involving school children. Various government bodies, including SEBI, the Ministry of Corporate Affairs, and MeitY, are investigating the platform following complaints. This investigation comes after the National Commission for Protection of Child Rights (NCPCR) raised concerns about the app’s content being accessible to children.

The Pune Regional Transport Authority has rejected the pending applications of Ola and Uber for an aggregator license. The rejection was based on document discrepancies and failure to meet the standards outlined in the government’s Motor Vehicles Aggregators’ Guidelines, 2020.

Used car marketplace Cars24 is piloting a new service in Gurugram that allows car owners to hire drivers on demand on an hourly basis. The service, launched earlier this month, offers options for round trips, one-way trips, and outstation journeys, with stringent driver verification and testing processes in place.

Lastly, investment tech platform Jar is reportedly venturing into the peer-to-peer (P2P) lending space with its new offering, Jar Plus, in partnership with Mumbai-based NBFC, P2P LenDenClub. Jar Plus has been rolled out for select users and aims to connect lenders with potential borrowers, similar to other P2P lending platforms.

[ad_2]

Source link