[ad_1]

High Street Essentials, the parent company of “FabAlley” and “Indya”, witnessed sluggish growth during the previous fiscal year ending March 2023. However, the losses for the Noida-based company also were flat during the same period.

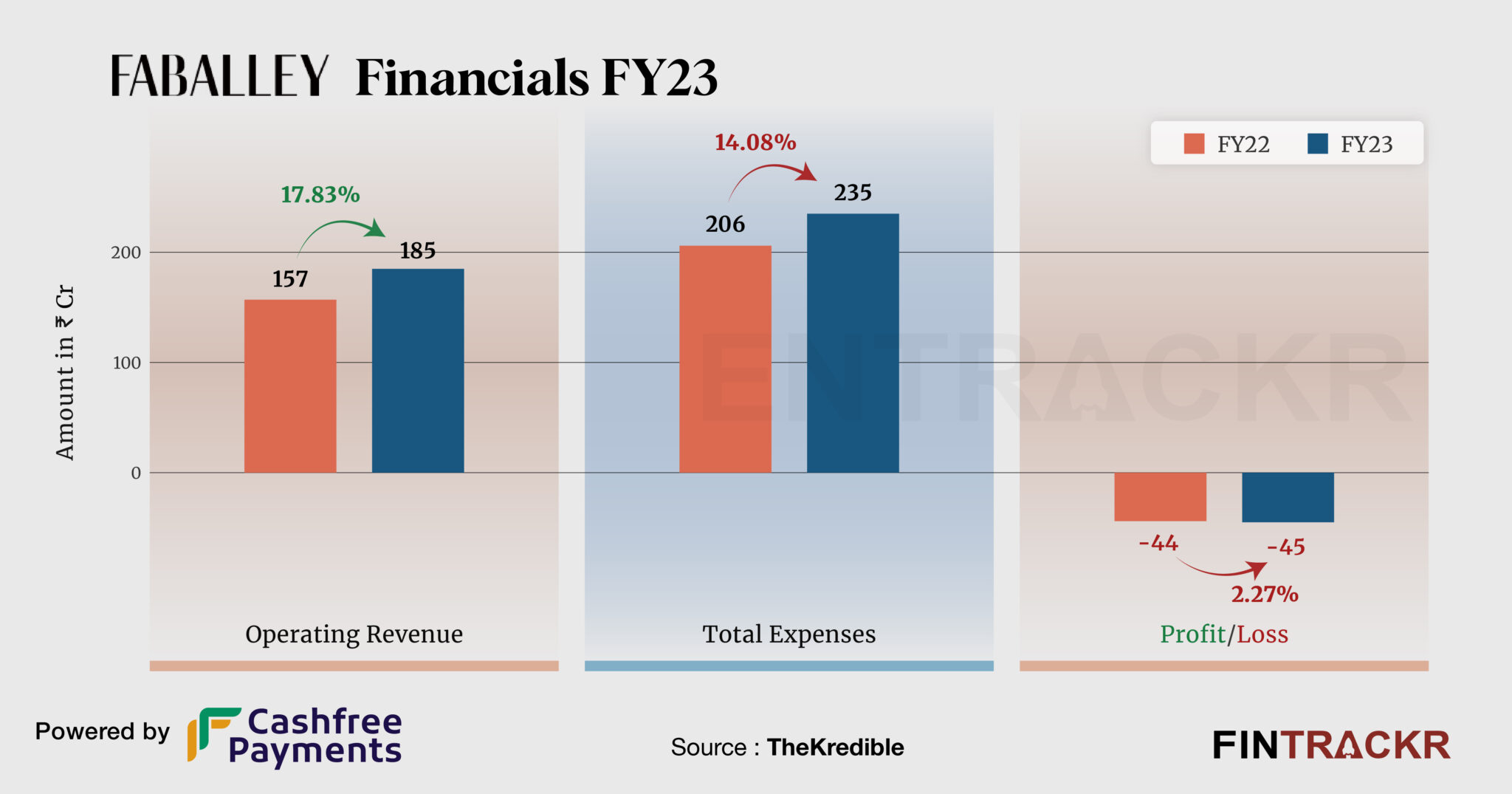

High Street Essentials’ revenue from operations increased 17.8% to Rs 185 crore in FY23 from Rs 157 crore in FY22, its annual financial statements filed with the Registrar of Companies show.

Established in 2012 by Shivani Poddar and Tanvi Malik, High Street Essentials has two women-focused brands – Indya and FabAlley. Indya specializes in offering ethnic clothing and accessories for women, whereas FabAlley caters to women’s Western apparel and loungewear needs.

The company claims to have more than 30 stores across the country. The sale of apparel constituted 77% of the total operating revenue which increased 12.7% to Rs 142 crore in FY23. The rest of the income comes from agency commission which increased by 38.7% to Rs 43 crore in FY23.

For the fashion brand, the cost of material consumed (procurement) formed 27% of the overall expenditure. This cost increased by 6.8% to Rs 63 crore in FY23. Its advertising cum selling cost saw a growth of 30.8% during the previous fiscal (FY23).

Its employee benefit, legal cum professional, freight, and logistics pushed the overall expenditure to Rs 235 crore in FY23 from Rs 206 crore in FY22. Check TheKredible for the detailed expense breakup.

Expenses Breakdown

Total ₹ 206 Cr

To access complete data, visit

https://thekredible.com/company/faballey/financials

View Full Data

Total ₹ 235 Cr

To access complete data, visit

https://thekredible.com/company/faballey/financials

View Full Data

- Cost of procurement

- Employee benefit

- Advertisement and sales promotion

- Selling and distribution

- Freight

- Others

The flat scale and cost did not affect its losses, which remained constant at Rs 45 crore in FY23. Its ROCE and EBITDA margin stood at -247% and -14.2%, respectively. On a unit level, it spent Rs 1.27 to earn a rupee in FY23.

FY22-FY23

| EBITDA Margin | -17% | -14.2% |

| Expense/₹ of Op Revenue | ₹1.31 | ₹1.27 |

| ROCE | -130% | -247% |

High Street has raised Rs 180 crore so far and is valued at Rs 700 crore. According to the startup data intelligence platform TheKredible, Elevation Capital is the largest shareholder with 28.18% followed by India Quotient. Its co-founders Tanvi Malik and Shivani Poddar cumulatively command 37.18% of the company.

[ad_2]

Source link