[ad_1]

Mumbai: British American Tobacco (BAT), the largest shareholder in India’s ITC, is working with Wall Street banks Citi and Bank of America to help pare some of that stake and raise up to Rs 21,000 crore ($2.5 billion), according to people with knowledge of the matter. This would translate to monetising 3.5-4% in ITC.

However, no transaction will happen until the Reserve Bank of India (RBI) approves the move.

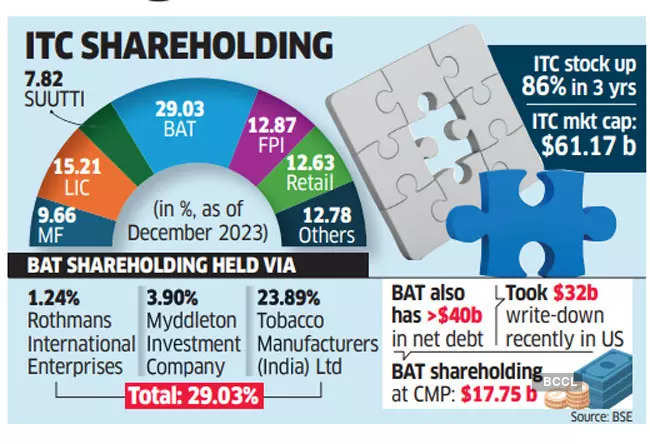

BAT has 29.03% holding in the cigarette-to-chips conglomerate, as per December 2023 disclosures. Based on Monday’s closing price, BAT’s shareholding is valued at Rs 1.47 lakh crore ($17.75 billion). ITC’s total market capitalisation amounted to Rs 5.07 lakh crore ($61.17 billion).

BAT sells cigarettes under brands such as Dunhill, Kent and Lucky Strike. The value unlocking could potentially help it prune leverage and resume a share buyback programme to enhance shareholder value. It launched the 2 billion buyback in 2022, but didn’t renew it last year.

The final sale price will be dependent on market value at the time of the transaction but people cited above said BAT, which initiated the exercise some time ago, is open to selling at a discount too, having bought the shares in various tranches since 1910, at a much lower price. The British company has been subject to numerous share capital changes such as stock splits and regulatory restrictions, including a ban on fresh FDI in the sector. It was once perceived to be hostile to the ITC management and a potentially unfriendly acquirer. However, of late, both ITC and BAT have been far more collaborative in nature, said people aware of the matter.

ITC Shares up 86% in 3 Years

“The past is water under the bridge. Now, the ITC top brass, under Sanjiv Puri, works closely with BAT,” said a company official.

ITC shares have risen 86% in the last three years, making the prospect of selling part of the holding an attractive proposition, especially when BAT is projecting “low single-figure” organic revenue and profit growth in 2024 because of an “expected slow recovery” in the US economy. BAT generated 27.3 billion pound revenue in 2023.

BAT’s application to sell ITC shares has been pending with RBI for approval for several months, said the people cited above. Since these shares were bought before the Foreign Exchange Management Act (Fema) was enacted, a multinational like BAT will need approval from the banking regulator to repatriate money after a stake sale.

BAT still has no clarity from the regulator but remains engaged with RBI, said people in the know. “RBI is the only regulator that needs to okay the transaction,” one of them said. “The shares have been held since a very long time when rules were different and the regulator is eager to know about the shareholding held in various forms and entities.”

Appointed bankers have reached out to several marquee institutional investors to gauge demand for large block trades and the response from long-only investors has been quite encouraging, said one of the persons cited.

“Nearly 70-80% of the potential book size has got a firm commitment,” the person said. “The advisors have lined up investors. It’s a high-value but sensitive trade, so you won’t take chances. The day RBI approval comes in, you will see everyone spring into action and within days, if not within one evening, post-market closing, the book getting fully built, as it will be very price-sensitive information, and the trade getting executed the next day before market opens. The investor approaches have either happened or are happening.”

BAT declined to comment on ET’s specific queries. RBI didn’t respond to queries.

BAT said on a February 8 earnings call that it has a significant shareholding in ITC, offering an opportunity to release and reallocate some capital. “We have been actively working for some time on completing the regulatory process required to give us the flexibility to monetise some of our shareholding and will update you at the earliest opportunity,” chief executive Tadeu Marroco said. The company didn’t provide a specific timeline.

India still strategic

However, BAT also clarified that it is not seeking to go below 25% in ITC — the minimum it needs to retain influence over the Indian tobacco maker. That will give the London-headquartered BAT veto rights, as no special resolutions can be passed by ITC without its consent, according to regulations. India remains a strategically important market, considering the slowdown in developed markets, executives said.

The clarification in a conference call with investors dispelled speculation about a major stake sale. The British company’s statement indicates that only a maximum 4.03% stake could be on the table, pending approvals. Despite its large shareholding, BAT is not classified as a promoter.

BAT told analysts in December last year that they are open to paring the stake in ITC. It had cited two hurdles — the Indian government’s ban on foreign direct investment (FDI) in tobacco and the permissions required from the RBI for any stake-related action. The restrictions limit potential buyers and impact value, analysts said.

Long Association

BAT’s holding is classified as FDI in stock exchange filings. David Robert Simpson and Sunil Panray are the non-executive directors on the board of ITC as representatives of Tobacco Manufacturers (India), a subsidiary of BAT, according to ITC’s FY23 annual report. Simpson resigned on January 30, citing personal reasons, an exchange filing said.

Analysts said lower leverage will help BAT regain its competitive advantage against rivals Philip Morris, Altria and Imperial. It had total borrowings of 39.73 billion pounds at the end of 2023.

“With overhang from a BAT stake sale, two taxation events over the next 12 months, and slowdown in volume growth, we expect the ITC stock to remain range-bound, going forward,” said Vivek Maheshwari & Kunal Shah, analysts at Jefferies, warning that a possible offloading of shares would create a supply overhang.

BAT has been facing challenges from declining cigarette volumes across its key markets, notably the US, where it took a $32 billion writedown recently. BAT also has more than $40 billion in net debt, which translates into 3x ebitda and nearly 60% of market cap, as per Jefferies’ calculations.

[ad_2]

Source link