[ad_1]

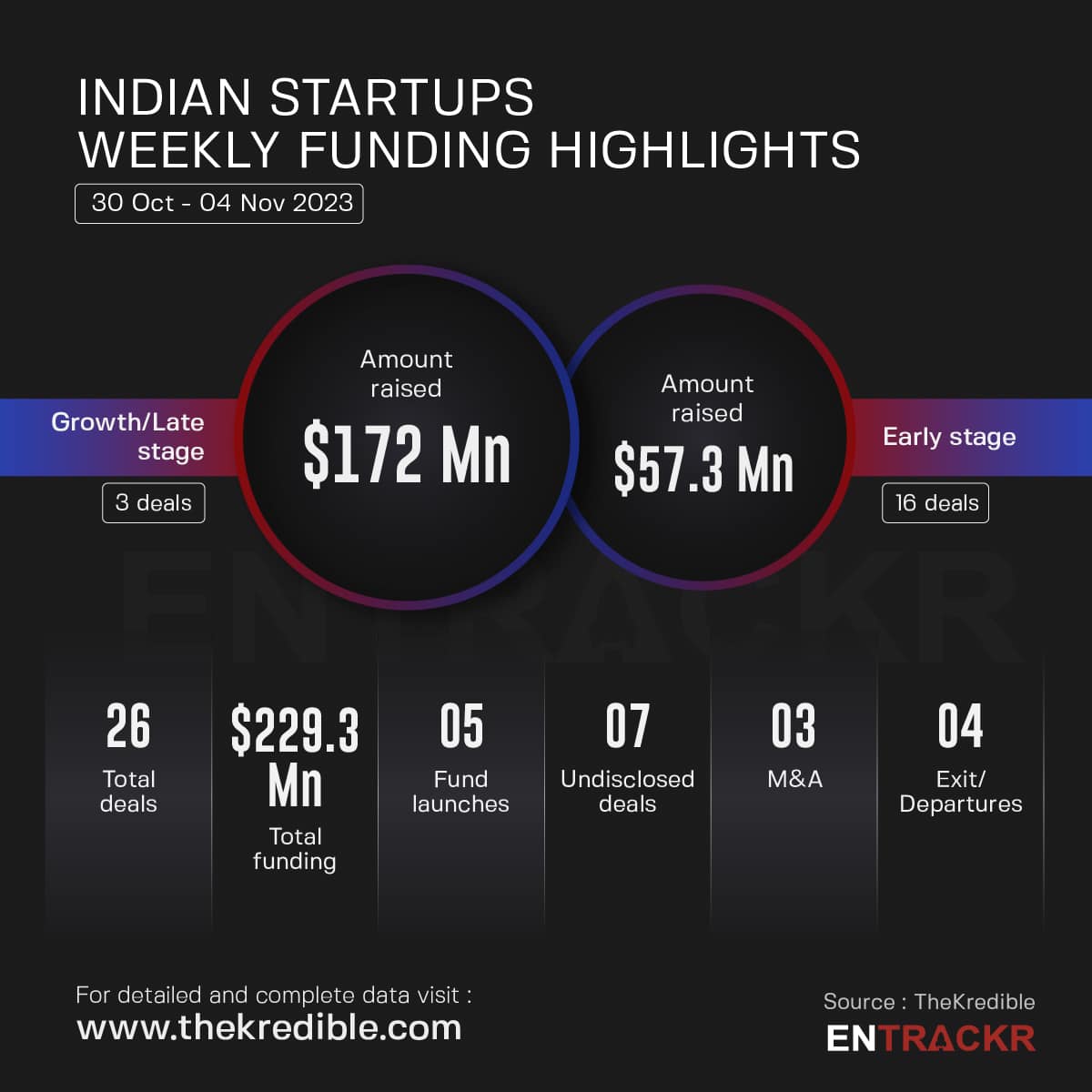

This week, 26 Indian startups raised about $229 million in funding. Following this, weekly funding again witnessed a drop of over 32% as compared to the previous week.

The 26 deals comprised three growth stage deals grabbing $172 million, 16 early stage deals contributing $57.3 million while the details of seven startup funding remained undisclosed.

Last week, 17 startups cumulatively raised around $339 million while the amount of a deal remained undisclosed.

[Growth-stage deals]

During the week, three growth-stage startups raised funding. D2C brand Mamaearth led the pack with $91 million funding followed by aerospace components manufacturer Aequs with $54 million funding.

Space-launch vehicle design and building company Skyroot Aerospace also bagged $27 million fund during the period.

[Early-stage deals]

In early-stage deals, tech-enabled brick and mortar housing finance company Vridhi Home Finance featured on top followed by diabetes care startup Sugar.fit and sustainable packaging firm Fibmold.

Other firms in the list include Aham Housing Finance, Growcoms, Kaabil Finance, Sweet Karam Coffee and Funstop among others.

Besides this, the details of seven funding deals remained undisclosed including a secondary transaction in e-commerce firm Purplle, seed funding of Fruitfal, pre-seed round of MyEra along with a seed funding deal of Ludo Superstar maker BlackLight Studio Works. For more information, visit TheKredible.

[City and segment-wise deals]

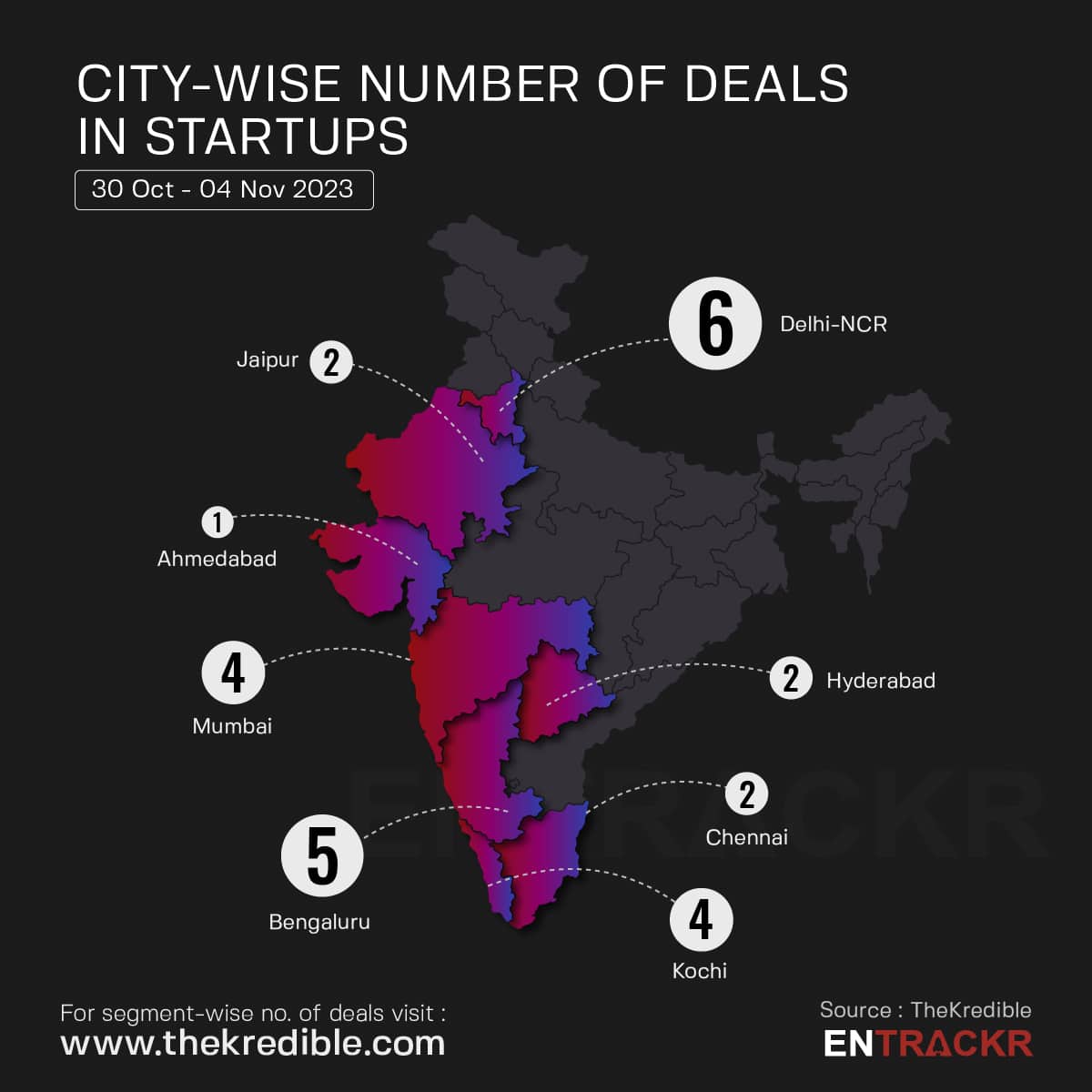

Leaving behind Bengaluru, Delhi-NCR-based startups led the list of city wise deals with 6 deals raising nearly $94 million or 41% of the total funding. As per TheKredible, Bengaluru, Mumbai and Kochi-based startups followed the list with 5, 4 and 4 deals, respectively. Chennai, Jaipur, Hyderabad and Ahmedabad-based startups are next on the list.

The complete breakdown of city and segment can be found at TheKredible.

[Series wise deals]

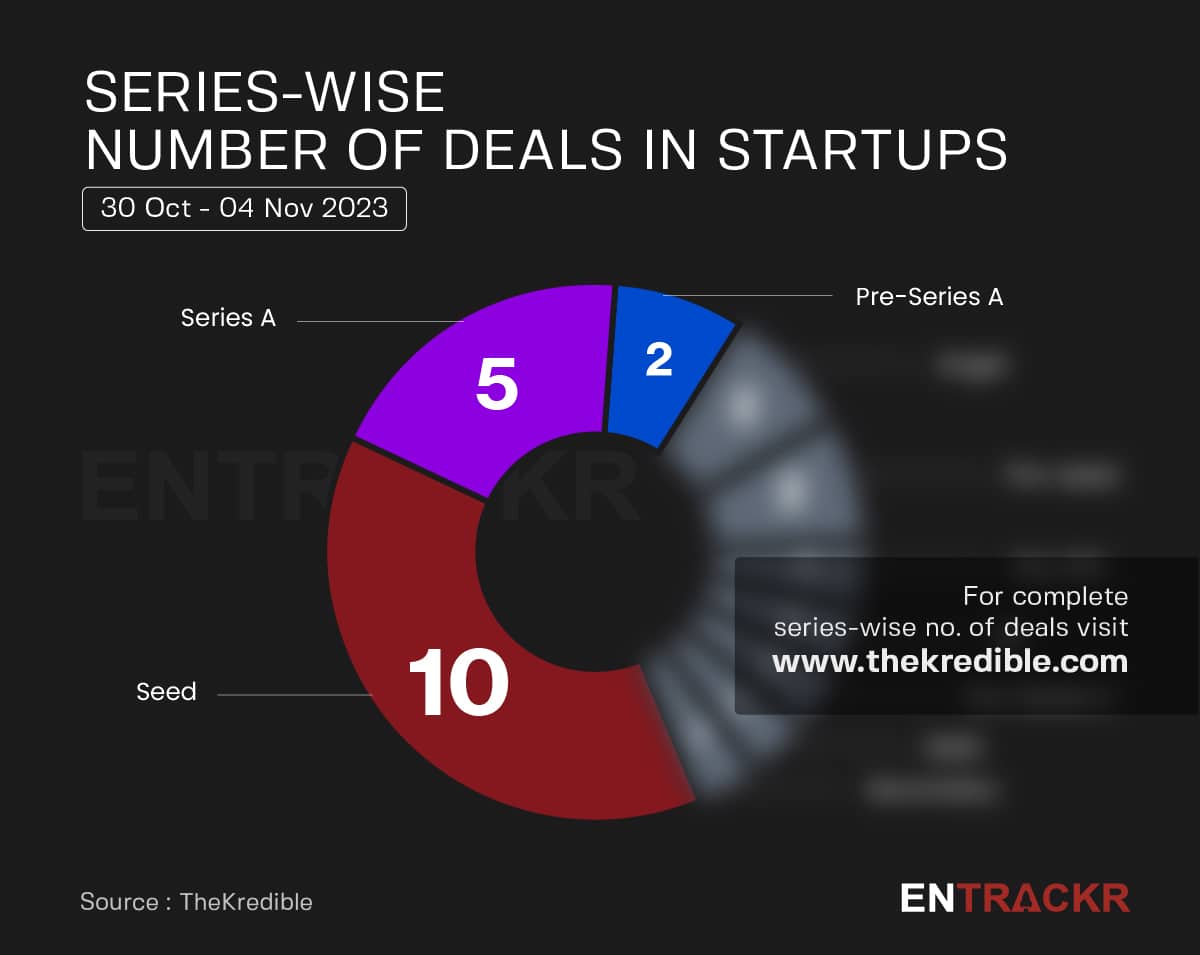

Seed stage startups dominated the chart with 10 deals followed by 5 deals by Series A stage startups. Further, the list counts pre-Series A, pre-seed, pre-Series C, pre-IPO, Angel, and Secondary funding deals.

[Week-on-week funding trend]

On a weekly basis, funding again plummeted under the $250 million mark after crossing the $300 million threshold last week. Subsequently, the average funding in the last nine weeks stands close to $244 million with a deal size of 20 per week.

[Departures]

As we highlighted in our monthly report, there is a sharp fall in layoffs and this week, there were no reports on layoffs available in the media. However, the exits of top level employees continued as usual. This week, Unacademy’s CFO Subramanian Ramachanran, Nazara-owned Nodwin’s CEO Siddharth Kedia, edtech company Eupheus Learning’s MD and Swiggy’s senior vice president Karthik Gurumurthy stepped down from their positions. Gautam Singh Virk, the co-CEO of Nodwin, will be responsible for handling the operational aspects of Kedia’s role. Meanwhile, CFO Karandeep Singh will now be in charge of acquisitions and investor relations. Edtech company Unacademy also appointed Sandhydeep Purri as its Chief People Officer (CPO).

Visit TheKredible to see fund launches, series wise deals and amount breakup, and more insights.

[New launches]

[Financial results this week]

[News flash this week]

[Entrackr’s analysis]

While weekly funding dropped by over 30%, there is a rise in funding in startups from spacetech and agritech space. Looking at recent trends, it appears the startup ecosystem is regaining stability, evident from the declining trend in layoffs. This week also marked a significant increase in fund launches, one of the most robust periods in months.

Moreover, Titan Capital made headlines by achieving 100X return on investments in Ola and Urban Company in the past. Several companies demonstrated strong financial performances, with Zeta India turning profitable in FY23, healthcare-focused edtech firm DailyRounds recording an impressive Rs 281 crore in profits, and Zomato securing consecutive profits in Q2 of FY24.

[ad_2]

Source link