[ad_1]

Kota-fame Allen formed a new entity Allen Career Institute early last year to receive its maiden external funding round worth $600 million. The firm also completed its first fiscal year of operations and its numbers are astounding even as they are not comparable as it used to be a partnership firm until FY22.

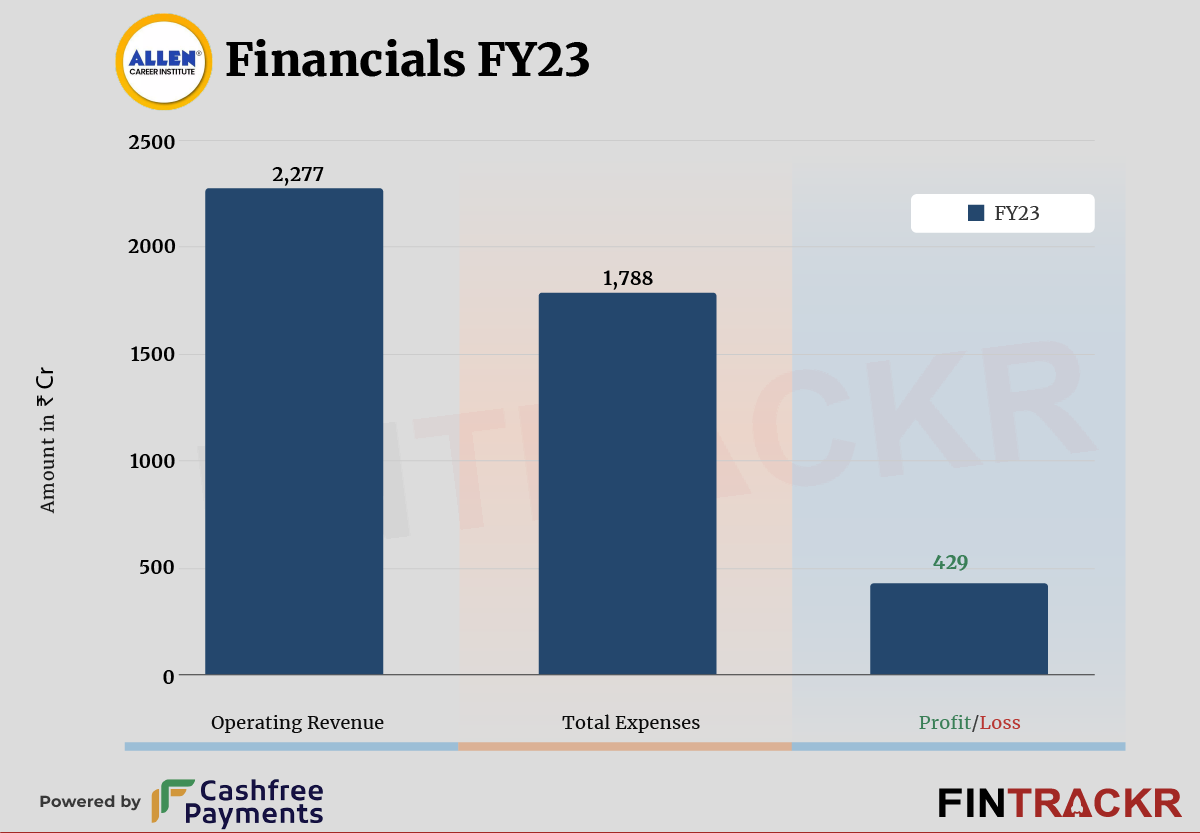

Allen’s revenue from operations stood at Rs 2,277 crore during the fiscal year ending March 2023, according to its standalone annual financial statements filed with the Registrar of Companies.

Founded by Rajesh Maheshwari in 1988, Allen is a test prep brand that provides offline, digital and distance courses for IIT JEE, AIPMT, NEET-UG, KVPY, and the Olympiads. The company claims to guide over 3 million students and operates over 240 classroom campuses along with 350 test centers.

Allen has a presence in 55 cities across India. The firm claims to have registered 1.27 lakh students for the academic year 2022-23.

Income from course fees/ tuition fees is the primary source of revenue for Allen Career Institute. The company also has some part of its revenue from the sale of books and study materials.

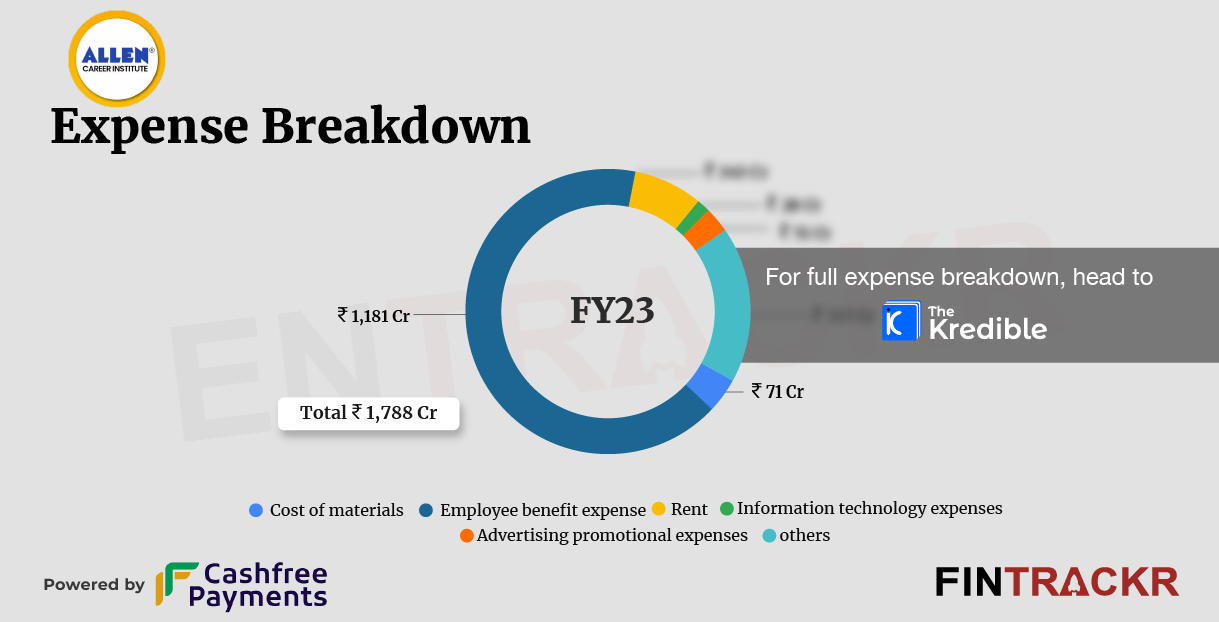

Similar to other educational institutes, employee benefits cost formed 66% of the overall expenditure. This cost was recorded at Rs 1,181 crore in FY23.

Its cost of materials, rent, information technology, advertisement promotional, and other operating overheads took its total expenditure to Rs 1788 crore in FY23. Check TheKredible to see the detailed expense breakup.

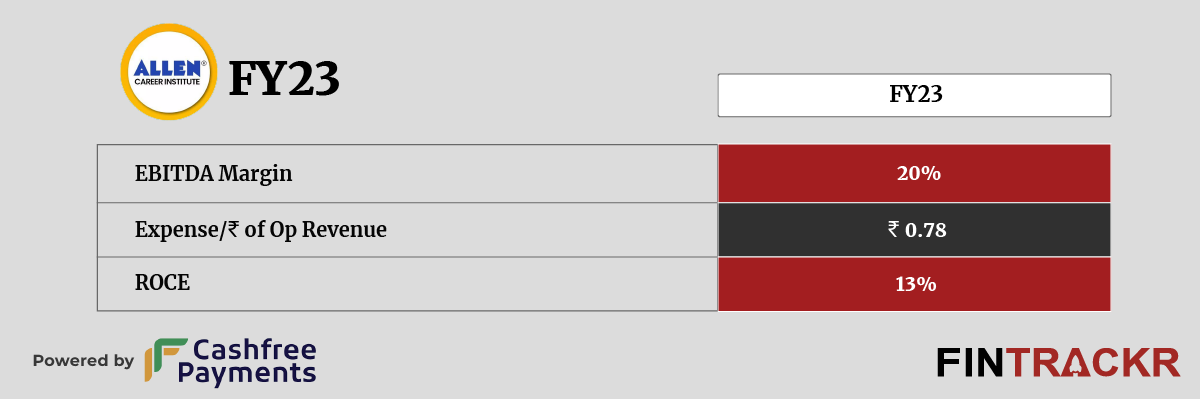

With the impressive scale and prudent cost mechanism, Allen Career Institute has managed to post Rs 429 profit after paying taxes in FY23. Its ROCE and EBITDA margins stood at 13% and 20% respectively. On a unit level, it spent Rs 0.78 to earn a rupee of operating revenue in FY23.

In May 2022, Allen raked in $600 million from Bodhi Tree Systems which is a newly formed platform between Lupa Systems founder and CEO James Murdoch and Uday Shankar, the former president of The Walt Disney Company Asia Pacific. The firm was expected to reach a valuation of $1.2 billion.

Allen’s superb numbers would seem to justify the rich valuations it received from investors, but it is also a fact that the firm is more the disrupted, than the disruptor in the edtech space. Assaults on its market share and consequently, profitability are bound to continue, even as the market remains a massive one. Investors have bet on the strong brand franchise, and a future where newer entrants will be offset by many older, small setups shutting down, ensuring no major hindrances to the stream of students hoping to get a ticket to an institute or a career through Allen’s portals. Regular changes in test methodologies, syllabus and more have ensured that the larger firms are better placed to adapt and communicate preparedness, even as the tussle between cheaper online classes and pricey offline continues.

[ad_2]

Source link