[ad_1]

Investment in Indian startups seems to be on track in October considering the past trend. This small but significant jump in monthly funding comes at a time when startups across the ecosystem are reviving themselves to overcome the funding winter. Interestingly, debt accounted for one third of the total funding in the last month.

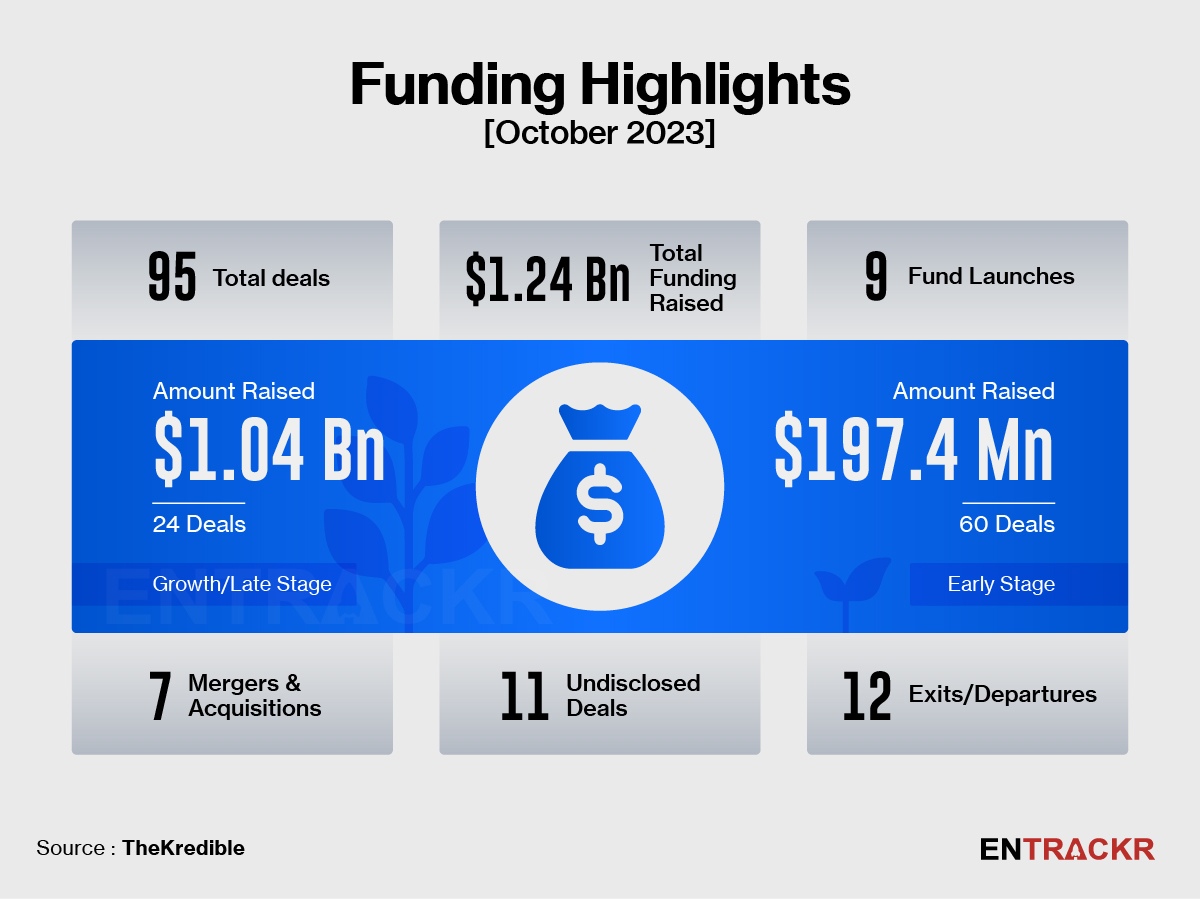

Data compiled by startup intelligence platform TheKredible shows that 95 startups have mopped up $1.24 billion in October. This includes $1 billion in funding across 24 growth-stage startups while early-stage ventures scooped up nearly $200 million. 11 startups did not disclose their transaction details.

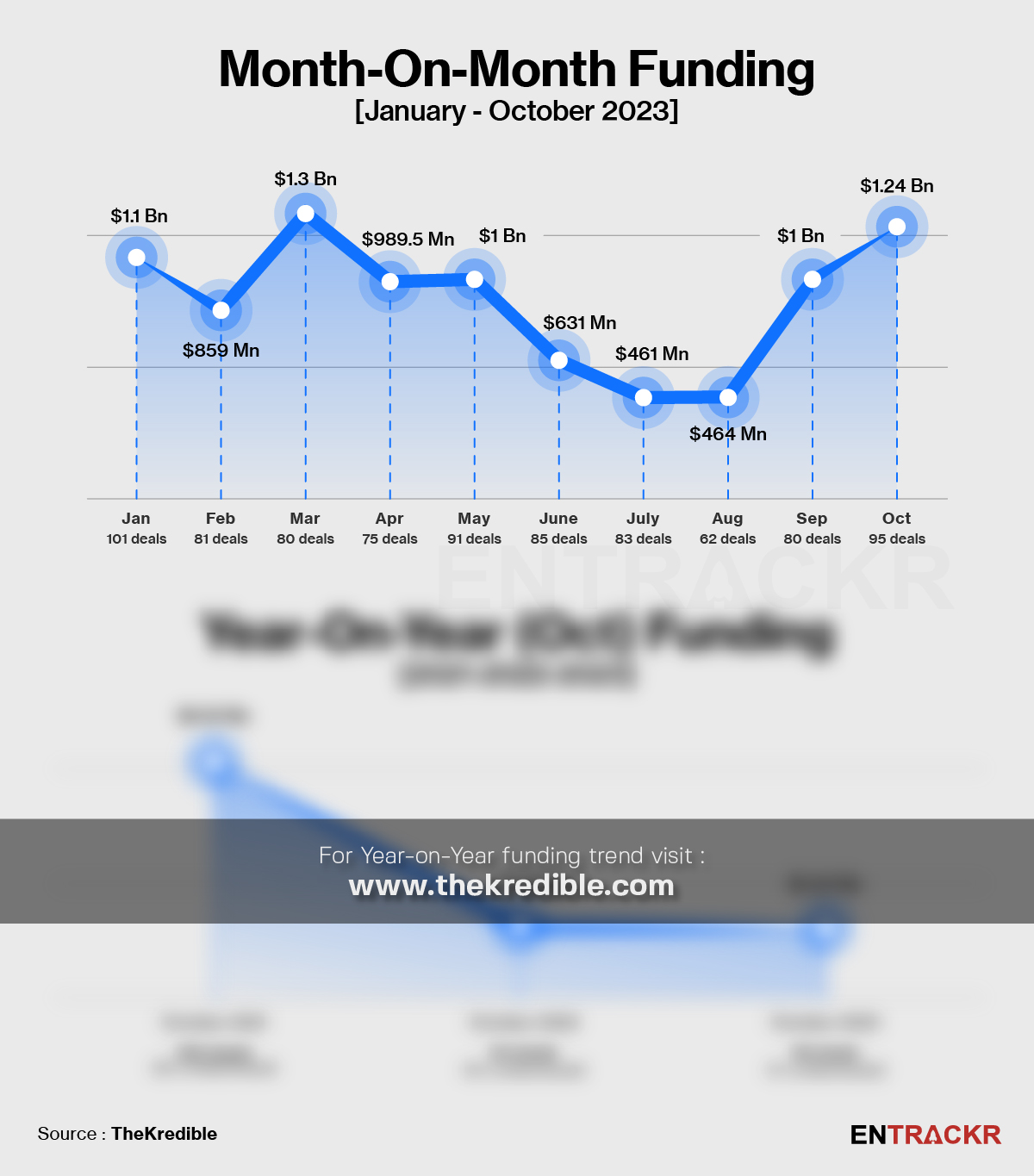

[Month-on-month and year-on-year trend]

After a downfall in monthly funding below $1 billion for straight three months (June through August), Indian startups have managed to post $1 billion plus in funding for consecutive two months since then. Also, October saw the second highest funding in 2023 after $1.3 billion in March. Interestingly, funding in October 2023 is on par with the same month a year ago (October 2022). The month-on-month and year-on-year trends can be seen below:

[Top 10 growth stage deals]

Once again Ola Electric led the pack with $240 million debt from the State Bank of India. With this, the company has raised more than $380 million including a $140 million round in September. Zetwerk and Zolve also raised $120 million and $100 million respectively.

Mamaearth’s parent secured $91 million in a pre-IPO round while Insurance tech startup InsuranceDekho also joined the top five list with a $60 million Series B round. InsuranceDekho became one of the few startups to raise two rounds in 2023. Its $150 million Series A funding came in February this year.

Besides Ola Electric and Zolve, Mensa Brands also raised debt among the growth-stage companies.

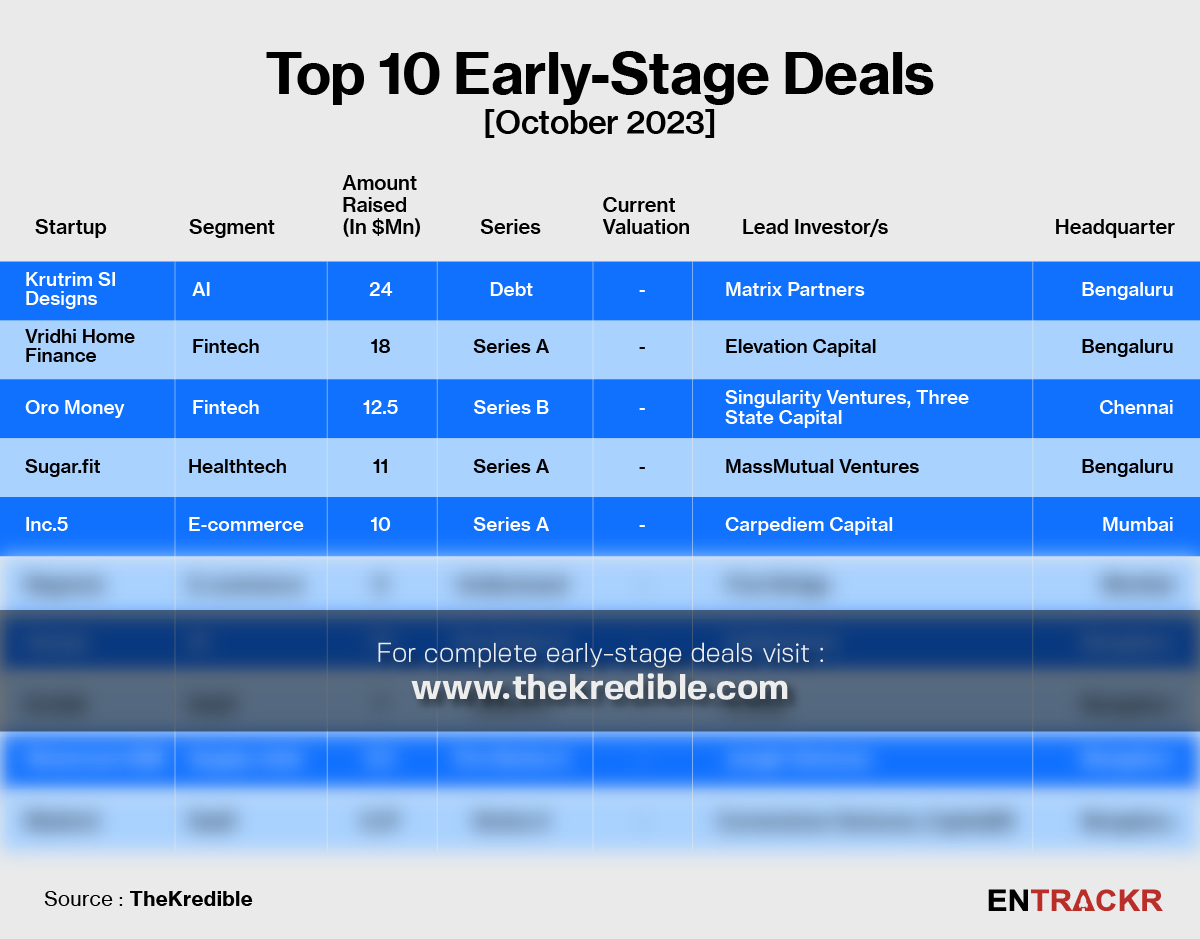

[Top 10 early stage deals]

Like the growth stage, early stage deals were also led by debt funding in October. Krutrim SI Designs, a startup launched by Ola founder Bhavish Aggarwal, raised $24 million in debt from Matrix Partners. Tech-enabled brick and mortar housing finance company Vridhi Home Finance, gold loan startup Oro, Healthtech startup Sugar.fit and D2C footwear brand Inc.5 also joined the top five list with more than $10 million in funding each. Check TheKredible for more details and full database.

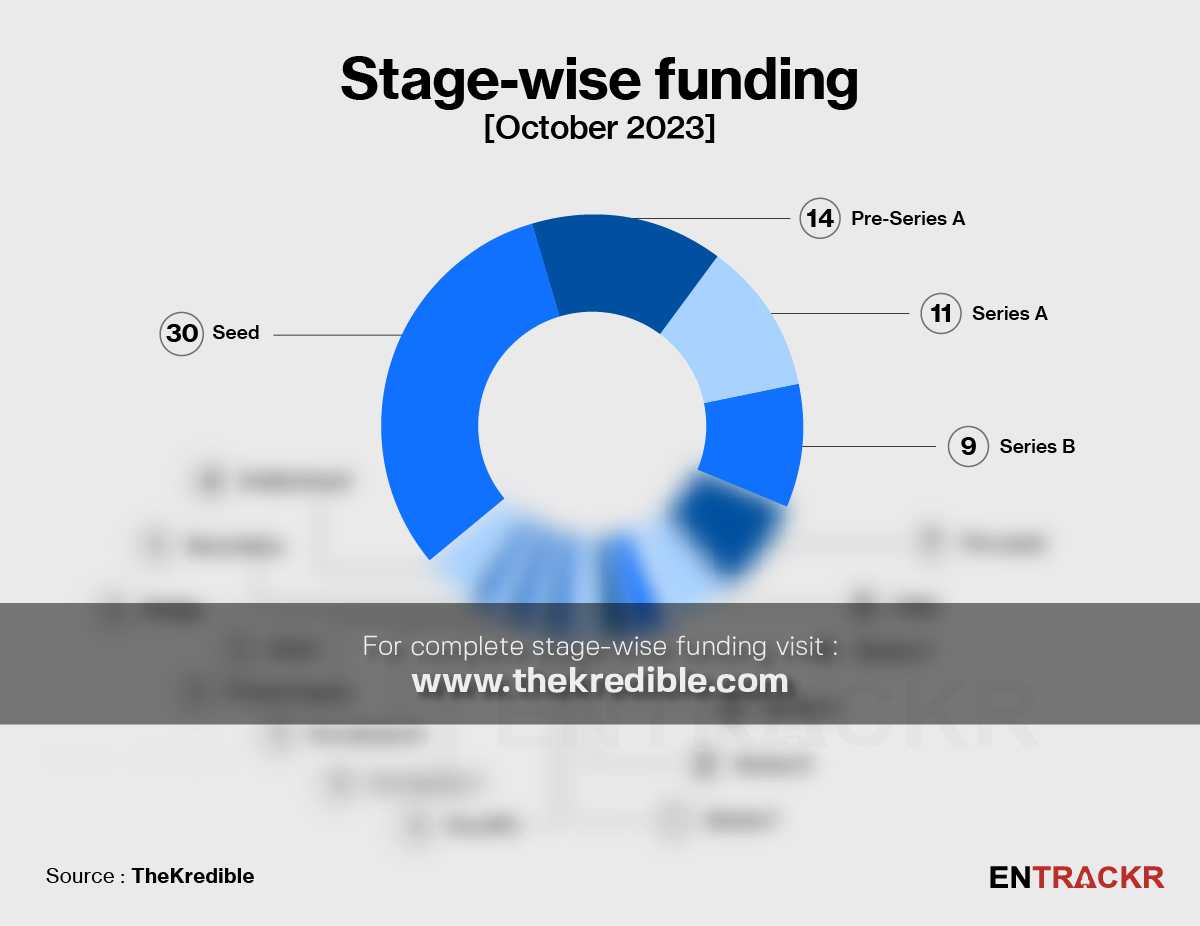

[Stage wise deals]

In October, the seed stage saw 30 deals while pre-Series A and Series A saw 14 and 11 deals, respectively. This was followed by 9 Series B, 7 pre-seed and 5 debt deals. In the late stage, Series D, Series E, and Series F saw 2, 2 and 1 deal(s) respectively.

The complete breakdown can be seen in the chart below:

[City and segment]

City wise, Bengaluru saw 39 deals and accounted for more than 60% of the total funding with $753 million. Delhi-NCR-based startups raised $254.8 million across 21 deals. Mumbai, Chennai and Hyderabad registered 17, 7 and 4 deals, respectively.

E-commerce startups dominated the segment chart with 17 deals amounting to $355 million followed by fintech startups which raised $248 million in 15 deals.

[Mergers and acquisitions]

There was a sharp fall in M&A deals in October as the startup ecosystem saw only 7 such deals during the last month. Among them, three unicorns Slice, Dream11 and Lenskart hogged the headlines. Fintech company Slice merged with North East Small Finance Bank whereas Dream11 acquired Sixer and Lenskart took full control over TangoEye. The list can be seen at TheKredible.

[Startup-focused funds]

Amid decent fund inflow, nine startup investment firms, including venture capital and debt firms, have announced their new fundraise. Flourish Ventures is on top of the table with a $350 million global fund. It has backed Indian startups like Indifi and ApnaKlub. Venture best firm ValuAble also announced its maiden fund with a $100 million corpus. The list counts Incred, Singularity and Paytm founder Vijay Shekhar Sharma’s new fund that will focus on EV and AI.

[Layoffs and departures]

Not only is there an increase in funding, October also witnessed fewer layoffs when compared to the previous months. As per data compiled by TheKredible, around 500 employees were laid off in October. Edtech startup Adda247 alone fired between 250-300 employees followed by CityMall, Bizongo and Graphy.

However, there is an uptick in the departures or exits of senior management employees at several startups and venture capital firms. This includes Byju’s CFO, Unacademy CFO, BharatPe CPO, and co-founders of Dunzo, Polygon and ZoloStays.

The total count of layoffs has gone beyond 22,000 in 2023 so far, which is 2,000 more than the previous year.

[Most active investors]

Peak XV Partners (including Surge), Inflection Point Ventures and Abhijeet Pai and Nikhil Kamath founded VC fund Gruhas co-led the list of most active investors with 4 deals each during October.

Subsequently India Quotient, Matrix Partners and Rainmatter Capital were next in the list. CRED founder Kunal Shah also invested in three startups namely Pep, Tap Invest and Fresh Bus during the period.

[Conclusion]

Between announcing unicorns every month and raising over a billion dollars in funding every month, there is no doubt what startups in India will prefer right now. The high shift to debt indicates the focus on established, growth stage startups, even as the situation remains challenging for pre-revenue and early stage startups. As it turns out, the cycle there will turn only with more successful exits for investors, like in Mamaearth, or a markup in valuations for those who have demonstrated results. We believe that moment is approaching yet again after a long slowdown, with startups across agritech, infra, fintech and more poised to rise yet again. Besides macro trends like the shift away from China, there is no doubt that improvement in the domestic market has also played its part, with India delivering higher growth rates than expected. Accordingly, we expert this trend to not only be maintained but for equity contributions to return, and remain at a higher proportion soon.

[ad_2]

Source link