[ad_1]

Ecommerce shopping during the first week of flagship sales has been off to a good start even though it remains to be seen if the trend will hold for another three-four weeks in the run-up to Diwali.

Brands and ecommerce platform executives said they have seen a better-than-expected start to festive season sales at the end of the first week, with deep discounts, shaking off concerns around an impact from the ‘Shradh’ period, which lasted till October 15.

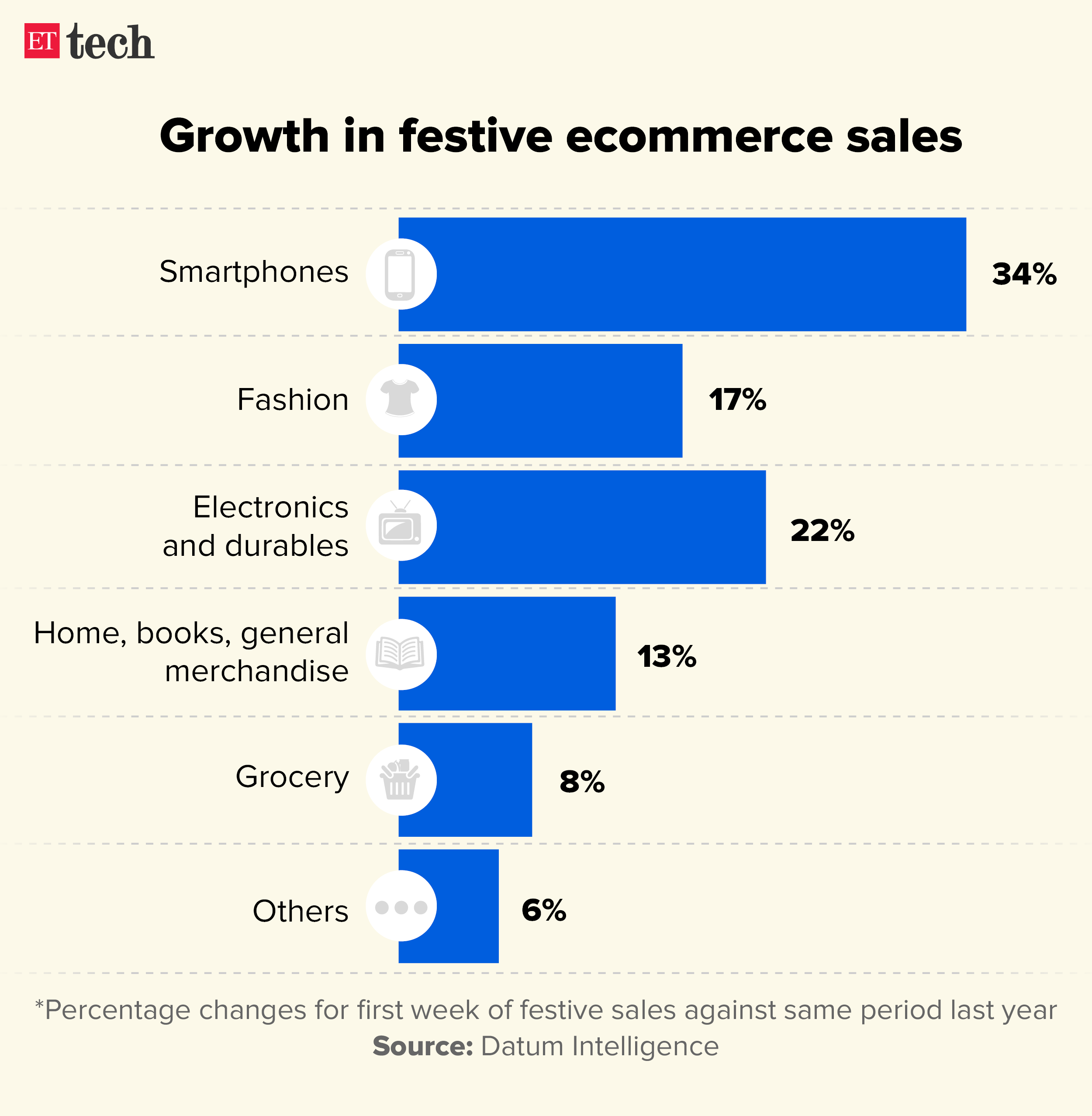

Ecommerce enabler firm Unicommerce, which tracks online sales data, said the Indian ecommerce industry reported a more than 30% growth in order volume terms between October 7 and 13. Between October 7 and 14, the ecommerce platforms clocked gross sales of more than $4 billion, an increase of about 18% from the first week of festive sales a year ago, said Satish Meena, an advisor at market researcher Datum Intelligence.

The period of ‘Shradh’, which fell between September 29 and October 15 this year, is a time when Hindus across many states in India venerate their ancestors – a solemn period when people refrain from making purchases.

“Compared to the first week of the festive period last year, we saw a three times growth in sales,” said Anurag Kedia, cofounder of beauty and wellness brand Pilgrim, which closed a $20 million funding on September 26.

Echoing Kedia, Boldfit founder Pallav Bihani said the healthcare brand posted a 3.5 times sales growth across marketplaces over the same period last year. “We’re seeing some great trends early on compared to a rather dull sale last year,” he said. Boldfit sells products like health supplements and sports equipment.

For individual brands, depending on the scale, the growth would be much higher compared to large marketplaces who move significant amounts of volume from sellers and brands across the country.

Multiple brands and sellers told ET they are seeing much more activity around advertising and supply-chain preparedness from ecommerce platforms this year compared to last year, and that helped increase overall activity on the platforms.

“Typically, during the festive season, due to the surge in demand, orders that were supposed to get delivered in 24 hours will take 36 hours, and so on. But this year, in spite of the higher base and higher growth, we are seeing much better customer service in terms of deliveries… You can’t make these changes overnight, so this is hardcore operational preparation,” said Kedia.

Categories that traditionally don’t receive much consumer attention during the festive season like health and fitness, and automobile parts also saw an uptick in sales in the first week, said executives and sellers in those categories.

Also read | Amazon, Flipkart, Meesho, other ecommerce companies may rack up $11 billion festive sales: report

Marketplace data

Walmart-owned Flipkart said it saw a record 1.4 billion visits during its flagship Big Billion Days sales, while Noor Patel, vice president at Amazon India, said its marketplace saw 95 million customers in the first 48 hours, along with a “huge” number of Prime sign-ups leading to the highest number of Prime members shopping in the first 24 hours of the sale.

Flipkart, in a statement, said fashion continued to be a key customer acquisition route. More than 44% of new customers came on Flipkart through fashion. Customer choices across segments like smartphones, laptops, and home appliances indicated premiumisation across the country, the Bengaluru-based firm said, adding it saw a 60% increase in Flipkart Plus memberships compared to last year’s festive season sales.

“We strengthened another pillar of the Indian retail ecosystem by expanding our kirana programme and this year, over four million deliveries were made by these partners in the initial days of The Big Billion Days,” said Flipkart group CEO Kalyan Krishnamurthy.

“Banks and other financiers look at this period as crucial for customer acquisition, retention and engagement, very much like the way we do. Their affordability schemes have helped drive a lot of the premiumisation trends that we have seen especially in large categories like smartphones,” said Amazon’s Patel.

Meesho, which focuses on low-priced products and markets outside metro cities, said 60% of its sales come from tier 4 towns in the first few days of sales, as opposed to 20% from tier 2 and 3 cities, and 20% from metros, said chief financial officer Dhiresh Bansal.

“I don’t think the acceptance of ecommerce in smaller towns is a question anymore… the focus is now on catering to that demand and improving supply chains for that,” said Biyani at Boldfit.

Discounts and more

In the beauty and personal care categories, discounts went up from between 10% to 25% on business as usual (BAU) days to between 20% to 40% on average during the first week of festive sales, Pilgrim’s Kedia estimated.

Chandigarh-based personal care brand LetsShave, backed by Wipro’s venture arm, saw a four to five times jump in sales during the festive season compared to usual days. The startup’s founder Sidharth Oberoi said Amazon was the biggest platform for the company’s marketplace strategy, and discounts were key to the brand’s festive season approach.

Brands also alluded that discounting during the festive season sales was an important value proposition in driving consumers to make purchases during this period. “Discounting of products during the festive season sales is higher than usual, but that’s the idea behind these sales – that the customer gets prices that are lowest in the trailing six months; that’s the value proposition to the customer, thereby also encouraging the customers to try on newer brands,” said Sumant Kakaria, cofounder and CEO of Gurgaon-based D2C casual footwear startup Solethreads.

Fireside Ventures-backed Solethreads saw a month’s worth of revenue in the first three days of the festive season sales, Kakaria said, adding that there was “good traction across all of Solethreads’ stock-keeping units”. He also said what helped the brand in this year’s sales was the sharper focus of horizontal marketplaces like Flipkart and Amazon on the fashion category. “This means having priority in terms of cataloguing, marketing slots, inventory management,” Kakaria said.

[ad_2]

Source link