[ad_1]

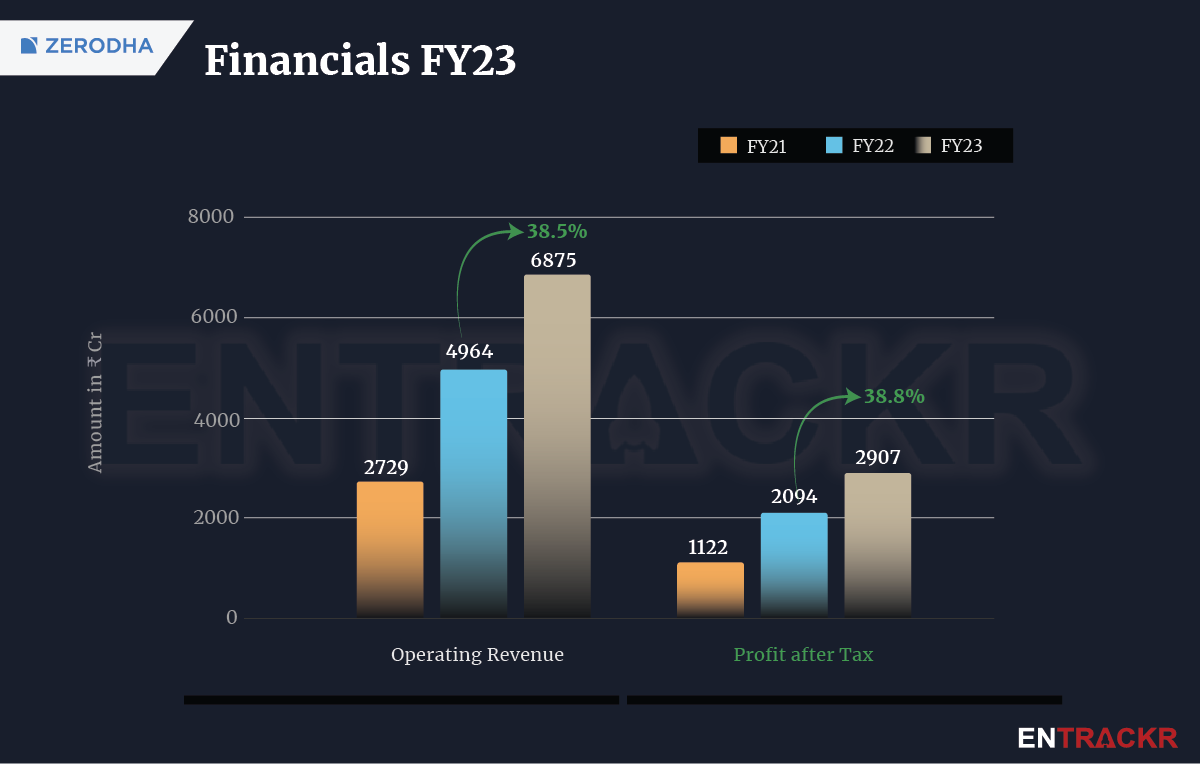

Stock broking platform Zerodha has continued its growth momentum in the fiscal year ending March 2023 but its scale didn’t grow akin to FY22. The Bengaluru-based firm’s operating revenue grew 38.5% during the previous fiscal year as compared to an 82% jump during FY22

Zerodha posted Rs 6,875 crore operational income in FY23, according to the company’s disclosure in a blog post. Akin to its revenue, the company’s profit also grew 38.8% to Rs 2,907 crore.

Zerodha’s profit growth also fell by over 50% in FY23 as compared to FY22 where it registered 86% jump in profit as compared to FY21.

Zerodha’s active client percentage on the National Stock Exchange saw a dip during the current fiscal year, which Founder and CEO Nikhil Kamath explained. “We have seen a small dip in customer ratings since May 2023. This is due to accounts being deactivated by exchanges and depositories due to PAN not being mapped with Aadhaar.”

The forced deactivation of accounts due to the new KRA policy around verifying mobile numbers and email addresses and updating income details for the trading account also contributed to many customer complaints and a dip in the rating, said Kamath in the blog post.

Kamath further added, “We have twelve crore demat accounts (non-unique) in India, and NSE active client data indicates ~3 crore Indians who traded once a year (unique) on the exchange”.

According to Kamath, Zerodha manages approximately Rs 3 lakh crores worth of customer assets. It’s worth highlighting that Kamath already estimated a 30-40% dip in revenue for the ongoing fiscal year or FY24 as account openings were down 50-60% from all-time high.

Data sourced from NSE shows that Zerodha had 6.3 million active users followed by Groww and Angel One with 6.2 million and 4.6 million users respectively as of August. At this rate, Groww is likely to surpass Zerodha in terms of active users in the coming weeks.

[ad_2]

Source link