[ad_1]

The consumer goods companies that have cut prices or have promotional offers running are seeing a clear pick-up in demand, with volumes rising as much as 25% in some categories.

High food inflation had dented demand in several categories as household budgets were disrupted.

Leading biscuit manufacturer Parle Products notched up 20% sales volume growth in the last few months, after offering a 7-10% price reduction via cuts or promotions.

Emami said categories such as healthcare and pain management saw 3-4% volume growth in the last two months after promotional offers. Adani Wilmar edible oil volumes surged 25% last quarter as prices plunged 40-45% over the past year.

Effect on electronics

Krishnarao Buddha, senior category head at Parle Products, said there is a strong and disproportionate correlation linking price cuts, demand and volume growth.

The price cut-volume growth effect is also visible in some electronic products. Companies have cut prices from last year’s peak to almost pre-Covid levels, passing on the benefit of a reduction in component costs.

According to the latest numbers by market researcher GfK India, television sales volumes grew 13% between January and June, compared with the year earlier. The value growth was just 2%, indicating a drop in prices. Similarly, for microwave ovens, the volume growth is 4% against 3% value growth in the same period.

LG Electronics business head for home entertainment Gireesan T Gopi said there has been an on-year erosion of more than 8% in the TV market by value in the first half of the year due to lower prices and aggressive promotional offers. “The strong volume growth increase is due to price drop and consumers upgrading their televisions instead of buying ACs, due to a cooler summer,” he said.

Until recently, value growth was driving most categories due to recurrent price hikes that did not impact volumes of premium products.

In the case of other consumer goods, higher prices dented volumes.

Macro factors

Adani Wilmar chief executive Angshu Mallick said India imported almost 22% more edible oil between November and June than in the year-earlier period, with lower prices raising consumption. “High imports are continuing even now. The price crash continues to improve consumer confidence,” he said.

Component shortages and supply disruptions due to the Covid-19 pandemic and the Russia-Ukraine war had sharply raised the prices of several goods and food items, forcing consumers to downtrade or postpone purchases.

Consumer inflation hit an eight-year high of 7.8% in April 2022. After easing to 4.3% in May this year, it rose to 4.9% in June, before surging to 7.4% in July. There was a drop in August to 6.8%.

Companies have either reduced prices, increased pack sizes or launched promotional offers.

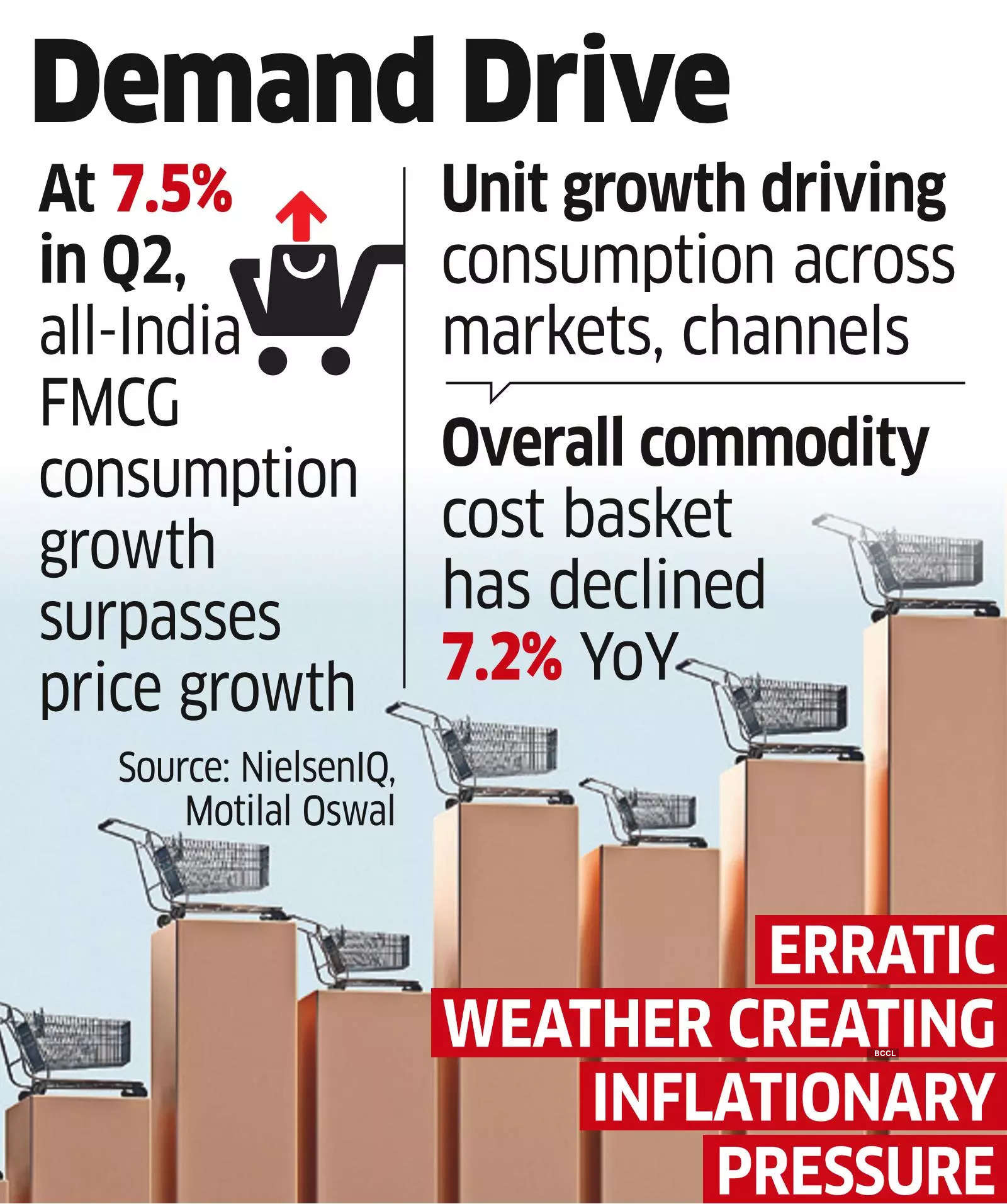

The overall commodity cost basket has declined 7.2% year-on-year, and rural demand has recently shown signs of rebounding after facing challenges for over a year, according to a recent report by Motilal Oswal. “There is a possibility of pent-up demand emerging, especially with the festive and wedding season approaching,” the report added.

[ad_2]

Source link