[ad_1]

Unilever said the Indian markis seeing a lot of aggression from small players in the FMCG sector after raw material prices cooled off, forcing its Hindustan Unilever subsidiary to focus on volumes and price cuts.

“In India, about 40% of our portfolio is fabric cleaning and skin cleanser. And we know from experience that they are highly correlated to the underlying commodity prices. When inflation happens, a lot of smaller local firms in the category drop out of the category and then re-emerge once deflation starts to come in. So, we are starting to see that in India,” Unilever global chief financial officer Graeme Pitkethly said at the Barclays Global Consumer Staples Conference.

For years, local brands have been nibbling away market shares from leading consumer product companies, especially in soaps, detergents, hair oil, tea and biscuits. However, pandemic-led disruptions and subsequent inflation in key raw materials forced many to either shut shop or scale down operations. However, in the past two quarters, soaps, detergents and tea have become cheaper due to falling commodity prices.

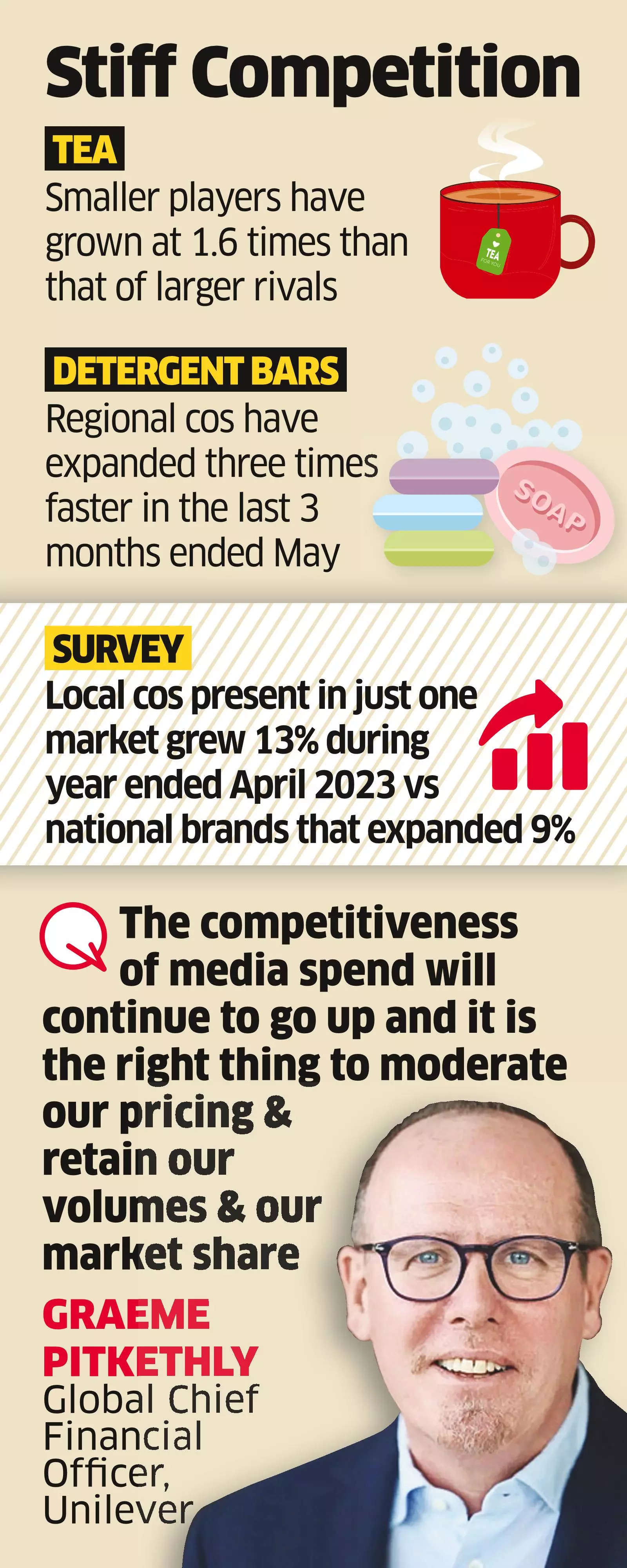

“The competitiveness of media spend will continue to go up and it is the right thing to moderate our pricing and retain our volumes and our market share. We really trust our team in India to manage that dynamics properly,” said Pitkethly.

Hindustan Unilever, during its earnings conference, said it was witnessing resurgence of small and regional players, many of whom had vacated the market during the peak of inflation.

For instance, within tea, small companies have grown at 1.6 times that of larger rivals in the three months ended May, while in detergent bars, regional players have expanded three times faster. HUL isn’t alone in witnessing smaller players eating into their market shares. During the June-quarter performance call, Britannia said its biscuit shares have been flat while local players gained share. “The local players, because of the pricing actions that they are taking in their small vicinity, have gained a little bit of market share,” Varun Berry, managing director at Britannia, told analysts. “When the inflation is high, local players just walk away. And when things start to become a little more normalised, local players come into the market and start to operate large schemes for customers as well as consumers. So that’s what we are looking at currently.”

Market research firm Kantar analysed 13 categories in personal care, home care and food and beverages and found that local companies, which are present in just one market, grew nearly 13% during the year ended April 2023 compared with national brands that expanded 9%.

[ad_2]

Source link