[ad_1]

As the battle for the smartwatch segment in India heats up, domestic startups in the space – primarily Noise, Boat, Fire-Boltt, and Boult Audio – have resorted to a bruising price war in a bid to capture market share – reminiscent of smartphone sales online a few years back.

Analysts have also pointed to the ability of smartwatch makers to drive down the prices of their products, considering the falling production costs. The price war is most evident in the lower end of the market, which is where most companies have been launching most of their new products over the last year.

Several top industry executives said while the competing firms are working on software plays and adding new layers on top of the core hardware offering, price being the major differentiator has impacted margins as well.

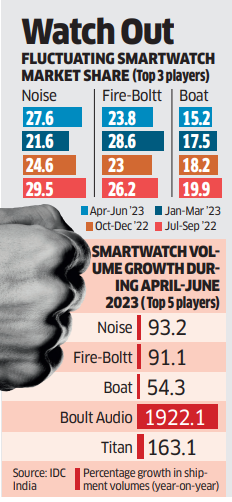

“There is absolutely no control on the pricing game and others (brands) are also forced to do it or you will lose market share,” a top executive in one of the leading brands selling smartwatches said. This, sources added, has led to fluctuation in the ranks almost every quarter.

Consider this: The latest report from electronic devices research agency IDC India showed Gurgaon-based Noise leading the pack in April-June in share of shipments with a 27.6% market share, followed by Fire-Boltt at 23.8%, and Boat with 15.2%. In the January-March quarter, Fire-Boltt bested the competition with a 28.6% share.

Boult Audio — a relatively new entrant into the space – grabbed a 3.4% bite of quarterly shipments in April-June 2023, an improvement from its meagre 0.3% share in the same period last year.

“Xiaomi had the market share two years back. Noise had it last year, and Fireboltt this year. But none of them have their own platform. Things will change soon with us, Titan and others coming in. We had a similar story in audio when we entered (competition),” Boat cofounder Aman Gupta told ET.

Boult Audio’s founder and chief executive Varun Gupta said that players in the smartwatch segment have their energies focussed on growth over profitability.

“To the credit of all brands, all four (Noise, Fire-Boltt, Boat and Boult Audio) have decent brand recall and awareness…so none of the players can charge a premium to their brand name,” he said, adding that customer loyalty was not in play at this point in time. “Customers are not so loyal to any brand unless they’ve already used the product…either in audio or smartwatches as a category. The supply is also getting cheaper by the day,” he added.

He also underscored there was no sense of comfort amongst players when it came to pricing. “To maintain the growth rate – that all the players are hungry for – everybody has extremely fierce pricing. No brand has that sense of comfort or complacency… nobody is saying that we’re okay with our 30-50% growth and we won’t drop our prices. If one does so, the competition will sweep away the prices. So everyone is on their toes and keeps reacting to each other,” he said.

Declining prices

IDC noted that the average selling price (ASP) of smartwatches in the country has fallen by almost 45% to $25.6 during the June quarter from $46.6 in a matter of one year.

Analysts pegged the decline in ASP to two factors — first, the fall in production costs, and second, the players in the segment focussing on the lower end to drive growth.

According to Counterpoint Research, the sub-Rs 2,000 retail price band captured 40% of the smartwatch market. “Earlier, the focus was to offer products for less than Rs 5,000…but now the price war has moved to less than Rs 3,000 and even sub-Rs 2,000 in some cases,” Anshika Jain, senior research analyst, Counterpoint Research, told ET.

Two senior ecommerce industry executives said with overall demand softening for big-ticket purchases, lower value gadgets like smartwatches drove much of the growth in recent sale events.

According to Jain, the sub-Rs 3,000 price segment commanded 64% of the shipment share in 2022, up from 55% in 2021.

“This share will further grow in 2023. The new launches that have been done by Fire-Boltt, Noise and Boat were less than Rs 2,000 price point…that’s what the players are targeting,” he said. Majority of this growth, he added, is being driven by first-time smartwatch users, or those buying it as a gifting option, making these customers highly price-sensitive.

Noise did not respond to queries seeking comment for this story. Messages sent to Fire-Boltt cofounder Arnav Kishore also went unanswered.

[ad_2]

Source link

![Read more about the article Funding and acquisitions in Indian startups this week [18-23 Mar]](https://gritlyf.com/wp-content/uploads/2024/03/Funding-and-acquisitions-in-Indian-startups-this-week-18-23-Mar-300x150.jpg)