[ad_1]

Financially stressed quick commerce startup Dunzo has held talks with its debt investors to restructure the terms of the credit so that the company can avail some of its cash lying in the bank to clear pending dues to vendors and staff salary arrears stretching to two months, sources aware of the discussions said.

The talks have been underway to finalise new terms, including the payback timelines, people aware of the talks said.

Dunzo’s efforts come at a time when it has simultaneously been looking to arrange new capital from both existing and new investors, ET first reported on July 18.

“There is cash in the company but debt obligations with cash flow are relatively stringent compared with equity investors. Dunzo had to take more debt as the April funding round took longer than expected and it needed capital to run operations,” one of the people mentioned above said. “This is similar to the PharmEasy situation where certain debt covenants, once breached, can restrict a firm’s ability to access its available cash.”

In November, Dunzo had made regulatory filings about closing a financing of around $6 million debt from Blacksoil. Sources, however, said the company has raised more debt since then.

“The information on the debt restructuring is inaccurate and we cannot respond to rumours without specifics. Our business operates with a healthy mix of debt and equity based on the best efficiencies,” a spokesperson for Dunzo said. The statement said its business has turned ‘contribution margin positive’ without giving any specifics and that it is seeing ‘interest’ from investors in ‘different forms of capital’.

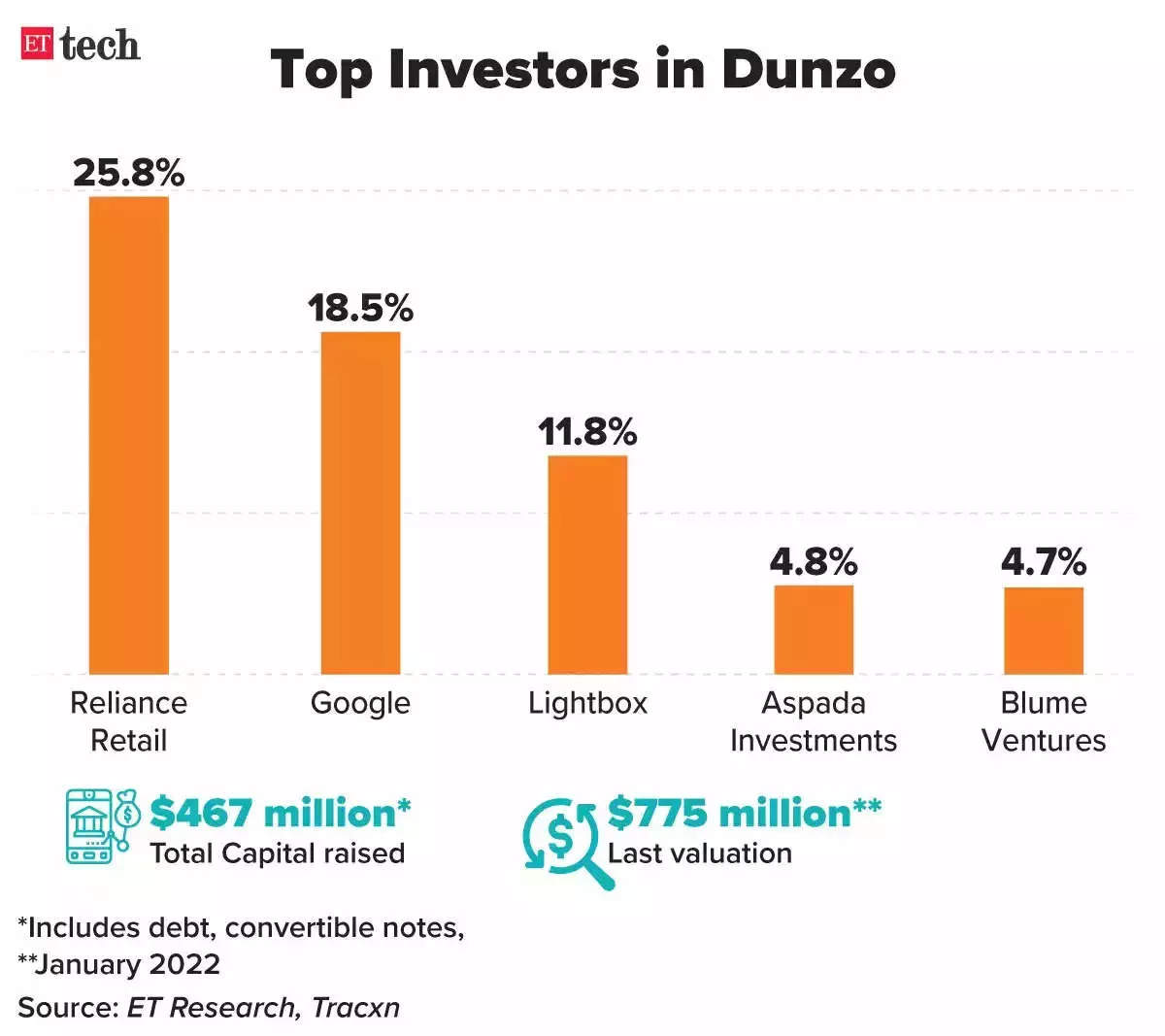

Emails sent to Reliance Retail, its largest investor with a 26% stake, did not elicit any response until the publication of this report. ET had reported in July that Dunzo had secured only $45 million of its planned $75 million financing through convertible notes.

JioMart fees

Meanwhile, Reliance’s JioMart has undertaken a change in its cost structure for its partners delivering orders.

In June, JioMart, the biggest customer of Dunzo’s B2B arm Dunzo Merchant Services (DMS), cut the prices it paid for last-mile deliveries made by bikes to Rs 35 per order, down from the Rs 58 per order earlier, multiple people aware of the new terms told ET.

JioMart also cut the payment for light commercial vehicles (LCVs) used by DMS to Rs 45 per order, from the Rs 58 per order earlier. To be sure, JioMart’s rate changes are applicable to all delivery partners of JioMart and the reduced rates do not exclusively apply to Dunzo.

ET also reviewed recent internal performance data that point to the altered rates.

JioMart, which accounts for around 30-40% of DMS’ total business, also stopped paying for repeated delivery attempts or failed deliveries by DMS that it used to pay for until June. This led to narrowing in gross margins for DMS from its services to JioMart for July in cities such as Bengaluru. The impact has been in the range of 50-75%, sources said.

Dunzo said it cannot comment on delivery pricing for any specific B2B partner as ‘it is privileged information’ related to its operational relationships with partners.

JioMart itself has been cutting down on costs over the past few months on cash-guzzling businesses and ET reported on February 17 that it had closed down its own quick commerce vertical, JioMart Express.

DMS serves more than 25,000 merchants and about 65-70% of them are in the food space, including McDonald’s, Licious and Theobroma.

DMS brings in roughly 35% of Dunzo’s overall revenues and does more than 30,000 orders a day, mostly last-mile delivery services. Operational in nine cities, DMS has taken on increasing relevance for Dunzo as the focus fully shifted to it, while the B2B vertical has been scaled down and left to grow organically.

Direct-to-consumer ops

Over the past few months, ET has been reporting about how Dunzo has seen its scale of direct-to-consumer operations under Dunzo Daily fall to almost one-fifth in recent times from the peak of 5.5 million monthly transactions it hit in June last year.

The Bengaluru-based firm operates only around seven dark stores now — all in its home market of Bengaluru — down from about 150 across the country until at least the middle of last year. Dunzo now mostly operates through partner stores.

The change in scale is visible in its services too. In central Bengaluru, for instance, a number of high population density areas don’t have the option of an “instant delivery” that takes between 20 and 35 minutes, meaning users opt for the “no rush” option that can take between 75 and 90 minutes, ET found.

Earlier, opting for the “no rush” option would earn users a discount of Rs 5 on their orders, whereas “no rush” orders are now charged delivery fees of between Rs 20 and Rs 30 when the order value of the items is less than Rs 349. These charges and timelines vary depending on the pin code.

On July 21, ET had reported on Dunzo laying off up to 200 employees as part of a plan to internally reduce costs by 30-40%, having earlier deferred employee salary payments for the months of June and July to September 4.

[ad_2]

Source link

![Read more about the article Funding and acquisitions in Indian startups this week [11-15 Sep]](https://gritlyf.com/wp-content/uploads/2023/09/Funding-and-acquisitions-in-Indian-startups-this-week-11-15-Sep-300x150.jpg)