[ad_1]

The world’s largest smartwatch market is about to get two new smart rings. While wrist-worn wearables are still wildly popular in India, a pair of domestic manufacturers are banking on consumers who are meticulous about health and sleep tracking but are less interested in the form factor.

BoAt and Noise are entering the smart ring market after putting up a tough fight against Apple, Samsung and Huawei with affordable wearables. The pair also frequently ranks among the top five manufacturers of wearable devices on the global charts. Last month, both companies announced plans to launch smart rings in India, though the devices have yet to hit shelves.

First, BoAt and Noise need to determine demand, but both are optimistic.

In the third quarter of 2022, the South Asian nation became the world’s largest smartwatch market, with 167% year-on-year growth, according to market research firm Counterpoint. India also recently surpassed the U.S. and China per IDC. A recent report by the firm shows the country saw a 37.2% year-on-year growth in the overall wearable market, with 32.8 million wearables shipped in the second quarter of 2023. India’s smartwatch shipments almost doubled to 12.8 million in the quarter, whereas earbuds saw a 15.2% year-on-year growth.

While traditional players like Apple and Samsung have seen increased shipments of their wearables in India in the last few months as the country saw a notable growth in premium smartphones, the market is primarily driven by local players, including BoAt and bootstrapped Noise. The primary reason for the continuous success of local companies is their focus on launching ultra-affordable, sub-$30 smartwatches and wireless earbuds that offer a look and feel similar to high-end devices. IDC said the country’s average selling price (ASP) of smartwatches declined by 44.9% to $25.6 from $46.6 in the second quarter. Further, the wearable ASP, in general, dropped to $21 from $26.7 a year ago.

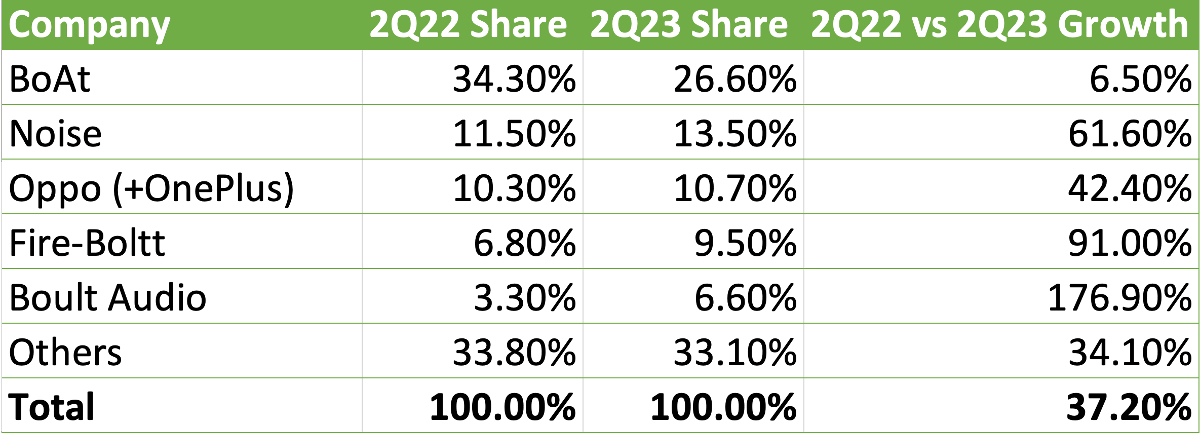

BoAt and Noise are the two dominant wearable makers in the country per IDC, with a market share of 26.6% and 13.5% in the second quarter, respectively. Chinese smartphone maker Oppo (which includes OnePlus), followed the Indian players in the wearable market with a share of 10.7%.

Top 5 wearable companies in India in Q2 2023. Image Credits: IDC

Low-cost devices have accelerated sales, but there are trade-offs. Still, the vendors are looking to offer as much functionality as possible at the low price point.

However, smart rings have thus far failed to drum up the same interest. While the smart ring market in the U.S. has startups such as Oura, India has Ultrahuman and Pi Ring as two of the early players. However, the arrival of BoAt and Noise may accelerate consumer interest and adoption.

“This move is likely to inspire other wearable brands to enter this category, leading to increased variety and choices for consumers,” Navkendar Singh, associate vice president at IDC India, told TechCrunch.

He added that there is a significant untapped potential for traditional wearable form factors, as well as new ones like smart rings. Like their competitors, BoAt and Noise both promise precise health and sleep tracking through their smart rings. However, they each have their target customer base.

BoAt’s CEO and managing director, Sameer Mehta, told TechCrunch that the startup — which started working on its smart ring in November — is targeting customers who are not first-time smartwatch users but rather those on their second- or third-generation smartwatches. For Noise, co-founder Amit Khatri said it looks at consumers who want accurate health and sleep tracking but don’t want to move from an analog watch. The startup has been working on the device for over a year.

Finger as the new nucleus

Tech giants such as Apple, Samsung and Huawei have long focused on the wrist. It’s not the most comfortable option for everyone, and it can be challenging to maintain precise tracking through the wrist. Ensuring that your smartwatch fits snugly to obtain accurate data is crucial. A smart ring can be the great solution, however, provided you have the right size.

A finger has access to arteries, which a smartwatch could not reach, Mohit Kumar, founder and CEO of Ultrahuman, which counts iSeed, Steadview, Nexus Venture Partners and Blume among its key investors, told TechCrunch.

“If you go to any medical grade pulse oximetry devices, you put it on your finger. You don’t put it on your wrist. That’s primarily because this is a much better source of data,” he said.

Khatri of Noise agreed with Kumar and said the data available through a finger is way higher than a device can get from a smartwatch.

However, the ring needs to have high-end sensors paired with precise algorithms to provide effectively accurate results. Fitting the sensors that are typically available in a smartwatch in a ring is a challenge for manufacturers. The other key challenge in smart rings is ensuring that they fit perfectly. A minuscule gap can alter the data these devices get from the finger.

Smart ring makers have created a sizing kit with a few average finger sizes they send customers to ensure the size is perfect. And for manufacturing, BoAt and Noise have chosen third-party manufacturers.

Khatri told TechCrunch Noise did the R&D of its smart ring, Luna Ring, from scratch. The startup has its vertical named Noise Labs for experimenting with different form factors, including smart eyewear.

“We have identified manufacturers who are doing it for the world’s best,” he said while answering the question about the Noise’s smart ring manufacturer.

Noise’s smart ring has been in the works for over a year. Image Credits: Noise

BoAt’s Mehta told TechCrunch that the startup selected a manufacturer in China to produce 5,000 units initially. Unlike BoAt and Noise, Ultrahuman produces smart rings at its facility in India. Kumar said the startup evaluated the option of going with an original equipment manufacturer (OEM) route but decided to set up its native production to have complete control over hardware and software.

“There are many, many OEMs available,” he said. “Most of these folks expect a certain volume, and they give you some firmware access but not 100% unless, of course, you have to deploy billions of dollars in capital.”

Ultrahuman sells its smart rings to the Middle East and London, alongside India. Kumar said India remains the dominant market, accounting for 9,000 monthly shipments out of the total 12,000 units that are shipped across markets. “India is still a larger one,” he said. “That’s probably because our distribution is in India; we initially launched in India.”

Ultrahuman has identified a potential customer base of 500,000 to 1 million individuals in India, and this number is continually growing, the founder said.

Pricing

Although data accuracy is essential in smart rings to retain customers, pricing is also vital to reach a broader customer base.

Ultrahuman currently sells its smart ring, called the Ring Air, for $349, while BoAt is looking to bring its offering with a price tag of sub-$80. Noise has yet to reveal the price of its Luna Ring, though co-founder Khatri told TechCrunch that it was looking at a “premium” segment this time.

In the U.S., companies including Oura have a subscription-based model where customers pay a separate amount regularly to access health and sleep tracking with their smart ring. Oura received criticism from customers after moving key metrics behind a monthly subscription paywall, even though it was already charging a substantial amount for the device. Indian players believe such a model does not work in the country.

Kumar of Ultrahuman admitted that the pricing of its smart ring is quite premium at the moment, and the startup was “trying a lot” to make it affordable.

“The only constraint that we have is that we need to have medical grade accuracy of the data,” he said.

Ultrahuman considers India to have “extremely value-conscious” customers. So, it wants to maintain its value while keeping the price high — higher than what is expected to be available through the new players.

Ultrahuman Ring Air is priced at $349. Image Credits: Ultrahuman

“There are two strategies: One is to sell to a mass and forget about customer feedback because you’re always selling to more people, or you sell to a niche, and you become more value-driven,” the founder stated.

Ultrahuman’s smart ring uses medical-grade sensors along with tungsten carbide–coated titanium.

Over time, the startup plans to introduce a Flexi Pay Plan, allowing customers to pay $25 monthly instead of the entire amount upfront. However, it still does not want to go with a subscription model.

“Subscription is a flawed model in this product specifically. Many companies in the U.S. are charging a fixed fee plus $8 a month. For the consumer, that’s extremely unfriendly because the hardware is not the same after a few months, so why will you need to pay the same amount?” Kumar said.

Ultrahuman also sells its arm-mounted continuous glucose monitor (CGM). The device was originally designed for individuals with diabetes or pre-diabetes to keep track of their blood glucose levels. However, the startup has introduced an integration between its CGM and smart ring by claiming to offer “deep correlations and predictive insights” through pairing the two.

Kumar told TechCrunch almost 35% of people who buy the ring also end up using the CGM. Like Ultrahuman, BoAt and Noise are currently not looking to introduce a subscription-based model for their smart rings.

“Software-as-a-service (SaaS) doesn’t work in India. Even the likes of Netflix are struggling to have a subscription base, and entertainment is one of the biggest drivers in the country,” said Mehta of BoAt.

In the future, BoAt envisions the possibility of introducing a “recharge model.” This approach would allow users of its smart ring to access services by paying a nominal fee at regular intervals.

Oura declined to comment on plans for India.

Growing competition

India saw 100 million wearables shipped during 2022, according to IDC. Significant contributions came from affordable wearables from Indian players, including BoAt, Noise and Fire-Boltt. The trend is expected to remain the same this year.

“The increasing consumer demand for smart wearables as fitness trackers and lifestyle accessories has been a driving force behind the market expansion,” said IDC’s Singh.

Launching smart rings from BoAt and Noise is expected to bring competition to this nascent space.

“Smart rings offer the same health and fitness tracking capabilities without needing an external screen or occupying a real estate like wrist or ear, making them more compact and fitting seamlessly into the user’s fashion choices, providing added convenience,” Singh adds.

Kumar told TechCrunch that the new players would help increase adoption among offline retailers in the country. “If you go to an offline retailer today and say I am selling a smart ring, they say, ‘What do you mean?’” he said. BoAt and Noise will start selling their smart rings online, though both plan to bring them through offline channels soon.

BoAt has teased the launch of its smart ring in India. Image Credits: BoAt

Kumar also believes the new competitors would practically take some of Ultrahuman’s potential customers. “If we end up delivering more value on both hardware and software and, basically, a better experience. Of course, most people will migrate to us eventually,” he said.

Recent reports suggest that Apple and Samsung are also exploring possibilities to enter the smart ring market. However, both giants have yet to release their official details.

Noise’s Khatri said it would take some time for the established players to enter the market. “We are very nimble. We will fail fast . . . we can experiment faster as a startup,” he said. “For any bigger organization to launch a product, it’s a different ball game altogether.”

Nevertheless, introducing smart rings by these Indian players expands the range of accessible and affordable choices for consumers, offering alternatives until industry giants like Apple or Samsung eventually bring comparable offerings.

[ad_2]

Source link